- Altcoin correlation with Bitcoin weakens, signaling possible market divergence.

- Capital inflows continue, but Bitcoin’s hesitation fuels caution among traders.

Bitcoin’s rally through late April has begun to lose steam. Data shows that BTC is facing strong resistance of nearly $94,000, with recent candles pointing to market indecision.

The Relative Strength Index (RSI) has dropped to 58.85, after briefly sitting above 70 in overbought territory. This decline in RSI reflects cooling momentum and suggests a potential pause in upward movement.

On-chain data from the On-Balance Volume (OBV) has also flattened. This shift implies a reduction in net buying activity. Analysts observe that despite the strong push above $90,000, there has been no convincing follow-through. Without strong volume support, continuation becomes less likely.

Altcoin Correlation Breakdown Sparks Volatility Concerns

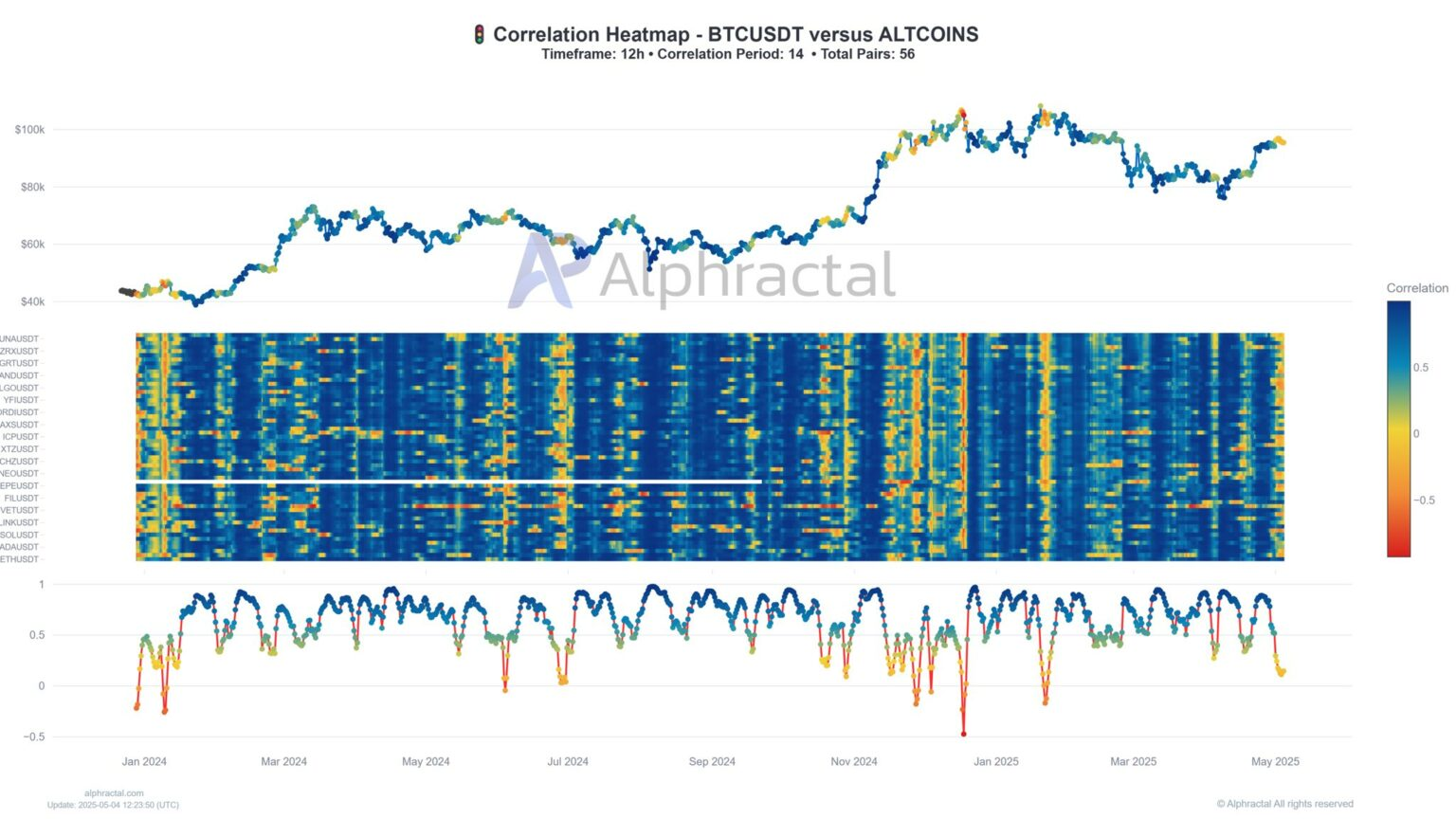

Recent data from Alphractal reveals that Bitcoin’s price is no longer tightly correlated with many altcoins. The 12-hour correlation metric across 56 altcoin pairs shows apparent fragmentation. Heatmap visuals now feature prominent red and yellow zones, pointing to weak alignment with BTC movements.

This breakdown is a potential red flag. Alphractal analysts suggest such divergences often surface during periods of shifting investor sentiment. When correlations break, it usually signals a redistribution phase, where institutional players begin adjusting their positions.

Historically, this has led to greater market volatility and unexpected price swings. With altcoins starting to act independently, traders may need to brace for unpredictable moves in both directions.

Capital Inflows Grow, But Caution Remains

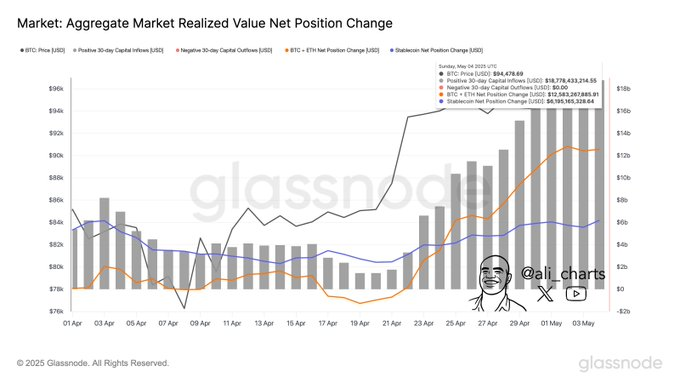

Despite the current signs of market instability, capital has continued flowing into crypto. Data from Glassnode and analyst Ali Martinez shows that around $19 billion entered digital assets in the last 30 days. These inflows have been seen across Bitcoin, Ethereum, and major stablecoins, indicating a growing interest in crypto exposure.

However, analysts caution against assuming this signals a bullish breakout. The fact that altcoins are rallying while Bitcoin remains stagnant is viewed as a liquidity shift rather than sustainable growth. Martinez notes that similar scenarios in the past have ended in sharp corrections.

Rising stablecoin inflows suggest traders prepare for increased risk, rather than jumping fully into long positions. Without Bitcoin confirming the next leg up, traders remain exposed to sudden downturns if sentiment flips.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.