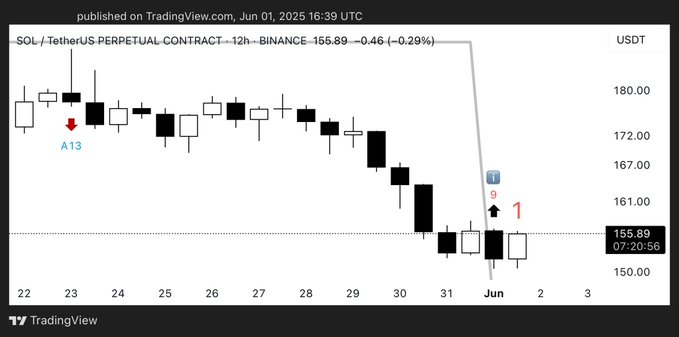

Solana flashes a TD sequential buy signal on the 12-hour chart, hinting at a potential price reversal.

Solana has faced bearish pressure over the past 5 days with consistent lower highs and lower lows. As of press time, SOL is trading at around $156, a 0.18% price upsurge alongside a 19.05% increase in 24-hour trading volume, per CoinMarketCap.

Is this a bullish spark or a bear trap?

A look into SOL’s price action reveals a “9” buy setup on the 12-hour chart, a technical indicator often seen at local bottoms. According to Coinglass data, the coin’s 24-hour open interest has surged 2.20% as the Open Interest (OI) Weighted Funding Rate turned positive. As the trading volume surges, SOL bulls could be charging with the momentum.

According to renowned crypto analyst Ali Martinez on X (formerly Twitter), Solana looks ready to bounce. Per Coinalyze data, SOL’s 24-hour long-short ratio stands at 3.74, suggesting heightened buying pressure at press time. With the Relative Strength Index (RSI) at 40.96, Solana has more buying potential if bullish momentum strengthens.

However, as of this writing, the MACD (12,26), the short-term and mid-term moving averages are flashing a “sell”, indicating a cautious attitude as traders anticipate strong price reversal confirmation.

A confirmed breakout above the $160 could trigger a bullish rally in the mid-term. Failure to hold above the $153 could resume SOL’s downtrend. Traders are closely monitoring these levels and buying volume for further insights.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.