- Aave nears $40B TVL and holds ~51% of DeFi lending; active loans $27.8B and fees >$3M/day signal real usage, not just price beta.

- 30d fees $100.5M vs. revenue $14.4M imply a ~14.3% take rate; value funnels to the DAO treasury, so AAVE upside depends on governance choices and treasury deployment.

- Strength rests on ETH/stables/LRT collateral, multi-chain liquidity, Morpho routing, and GHO growth; risk management, liquidation throughput, and L2 expansion will decide durability.

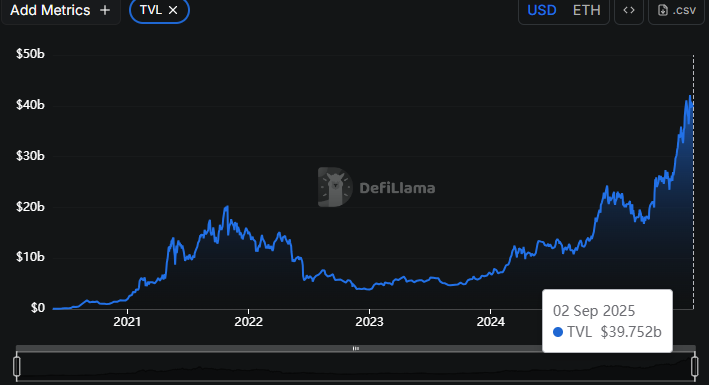

Aave extended its lead in DeFi lending with a new TVL milestone near $40 billion.

The protocol’s footprint has more than doubled since December on rising prices and renewed leverage demand.

Moreover, Aave’s fee engine accelerated, underpinning a stronger revenue outlook and expanding treasury resources.

Network Metrics and Market Share

Aave now commands about 51% of the DeFi lending market by TVL share.

TVL is USD-denominated, so higher ETH and collateral prices mechanically lift the figure.

Even so, consistent inflows and utilization gains point to real activity growth.

Active loans reached about $27.8 billion, up 21.6% month over month.

Thirty-day fees hit $100.5 million, up 34.2%, or over $3 million per day.

At that pace, the DAO’s fee run-rate comfortably exceeds one billion dollars annually.

Liquidity spans Ethereum L1 and major L2s, including Arbitrum, Optimism, and Base.

Routers like Morpho often route demand to Aave markets, reinforcing liquidity depth.

Isolated markets and new collateral listings broaden addressable demand while containing tail risk.

Revenue, Token and Treasury Dynamics

Reported revenue totaled $14.4 million over the past 30 days, up 5.7%.

That implies a protocol take rate near 14.3% of fees, consistent with reserve factors.

Annualized, revenue approaches $173 million against a fully diluted value near $5.1 billion.

AAVE traded around $313 as fully diluted value rose 26.6% in a month.

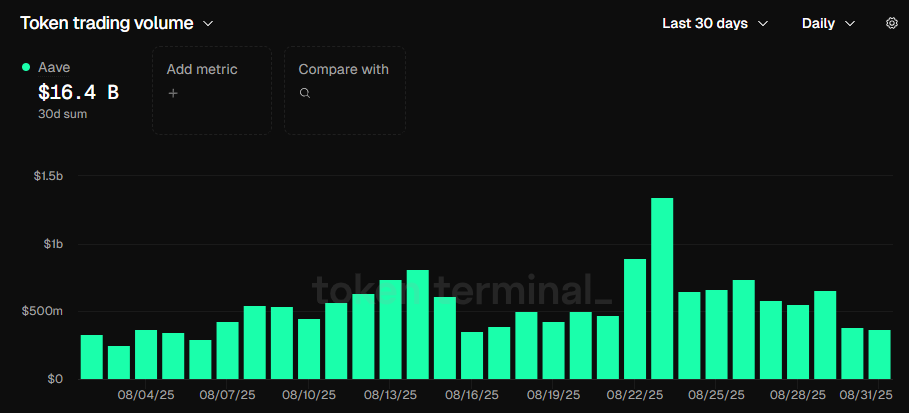

Thirty-day token trading volume measured $16.4 billion, down 12.6% month over month.

This pattern suggests firmer positioning while exchange churn moderated.

Protocol fees accrue to the DAO treasury, not directly to token holders.

Value reaches AAVE through governance, Safety Module incentives, and potential buybacks.

Therefore, future token performance depends on treasury policy and roadmap execution.

Collateral Mix, Risk, and Outlook

Major pools center on ETH, wrapped stables, and liquid restaking tokens.

Recursive loops thrive in uptrends, boosting utilization and fee capture.

However, sharp volatility can trigger liquidation cascades that compress activity.

Aave’s risk engine uses caps, LTV settings, interest curves, and liquidation incentives.

Past incidents produced limited bad debt, but scale increases operational demands.

Liquidation throughput and oracle robustness remain crucial in correlated drawdowns.

The GHO stablecoin adds a second demand vector for the ecosystem.

Deeper liquidity and improved peg stability could expand minting and utility.

Continued L2 expansion and disciplined risk controls will determine durability of current momentum.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.