- ADA maintained stability through 2024–2025, showcasing resilience and consistent accumulation despite multiple market corrections and volatility.

- With an active trading range between $0.60 and $0.70, Cardano continues to demonstrate maturity, liquidity, and strong structural support.

- Ongoing network innovation and blockchain adoption strengthen ADA’s long-term potential, positioning it for the next upward market cycle.

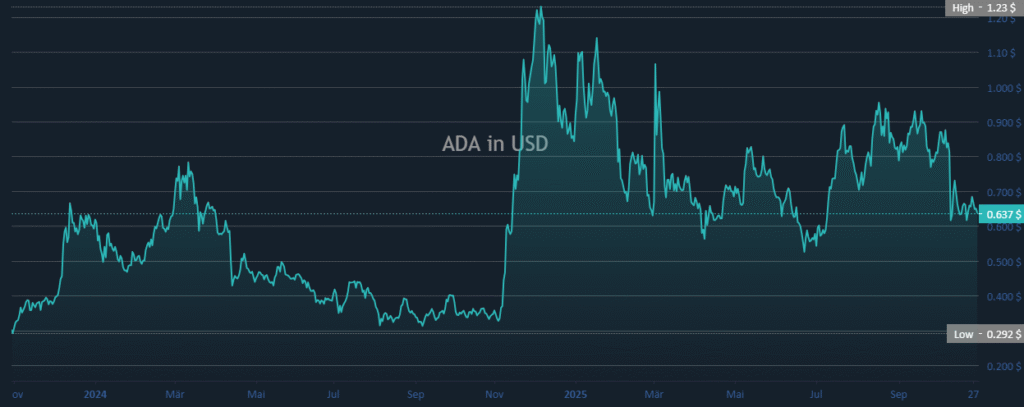

Cardano (ADA) traded steadily around $0.63 after a volatile year marked by sharp gains and subsequent corrections. The cryptocurrency displayed resilience throughout 2024 and 2025 despite heavy market fluctuations. Its performance highlighted steady accumulation and sustained participation within the broader blockchain ecosystem.

Furthermore, Cardano (ADA) began gaining traction in early 2024, advancing from lower levels near $0.30. The asset’s strong rally in February and March 2024 set the tone for a robust year. ADA later peaked at $1.23 in early 2025 before experiencing a healthy market correction.

Moreover, the retracement reflected profit-taking and temporary market cooling after an extended rally. Despite this, Cardano (ADA) continued to trade within a stable range supported by consistent trading volumes. The coin’s ability to maintain strength following pullbacks underscored its market maturity and long-term stability.

Market Behavior and Circulation Reflect Strength

Throughout the observed period, Cardano (ADA) maintained an average trading band between $0.60 and $0.70. This range acted as a support zone, attracting renewed activity during periods of broader market uncertainty. The pattern of recovery after dips reflected continued demand for the digital asset.

Source: blockchaincenter

Cardano (ADA) demonstrated a recurring cycle of expansion and consolidation. Such movements indicate growing structural resilience as the blockchain advances through network upgrades and adoption. The consistent price stability suggests balanced participation between market buyers and sellers.

In parallel, the overall market sentiment supported ADA’s steady performance. Despite short-term pullbacks, Cardano (ADA) held well above its recorded low of $0.292. This stability reinforced confidence in the project’s fundamentals and its expanding ecosystem.

Outlook Suggests Renewed Potential for Growth

Cardano (ADA) now displays consolidation behavior that often precedes directional momentum. The cryptocurrency’s consistent performance reflects both market adaptation and growing blockchain utilization. Its cyclical nature positions it well for future upward movements if external conditions remain favorable.

Furthermore, ADA’s steady technical structure suggests a foundation for potential recovery in the next market phase. The network’s continued innovation and development remain key catalysts for long-term valuation growth. Broader adoption trends could further enhance Cardano’s position among established digital assets.

In conclusion, Cardano (ADA) showcases a resilient and consolidating trend after an active trading cycle. Its strong fundamentals, balanced liquidity, and maturing market behavior point to a stable outlook. As the market evolves, ADA remains poised for renewed strength supported by steady ecosystem progress.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.