- ADA returns to key range with support and resistance shaping possible breakout levels.

- Audit confirms 99.7% of vouchers were redeemed and there was no misuse of ADA funds.

- Hoskinson rejects $619M seizure claims as tokens moved to custodial reserves.

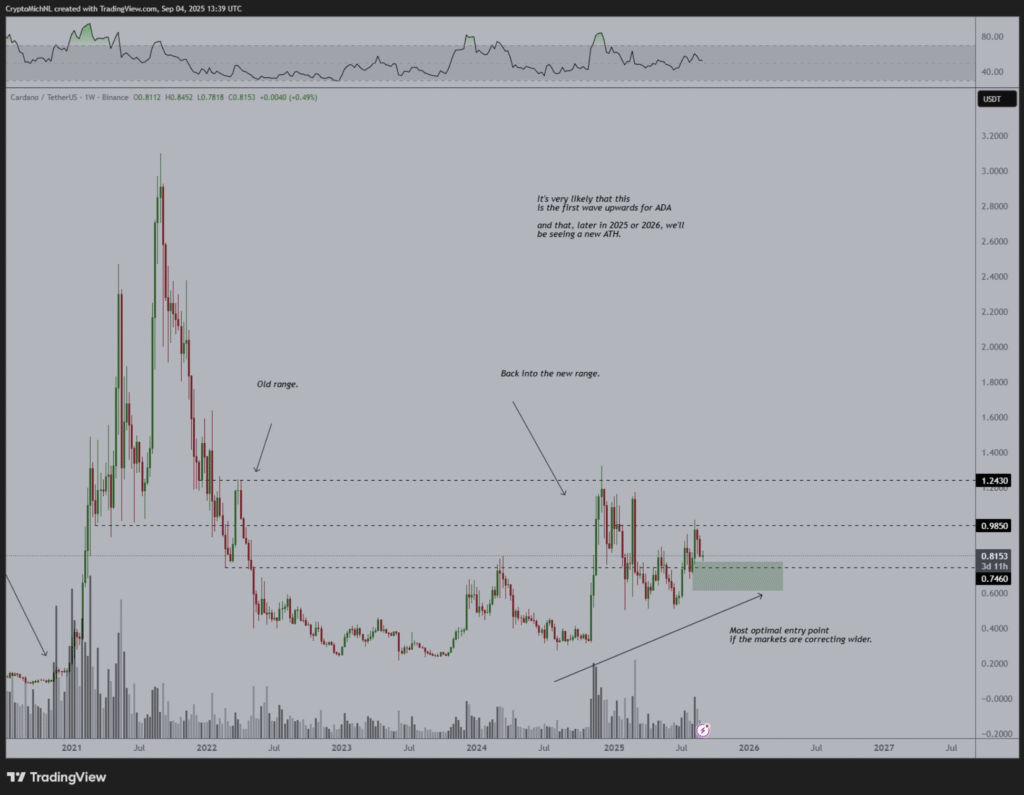

Cardano (ADA) continues to attract attention as analysts point to its potential breakout. Crypto analyst Michaël van de Poppe stated that Cardano remains overlooked by many but continues to strengthen.

ADA has re-entered a key trading range with a possible floor at current levels. Resistance levels near $0.92 and $1.24 are being watched as possible breakout points.

Traders indicated that the green support range may present an optimal entry should broader markets correct. Analysts added that ADA could be preparing for upside if momentum builds, with 2025 and 2026 viewed as possible years for new highs.

Fundamentally, Cardano’s network development is seen as consistent with the technical setup. The combination of chart structure and on-chain activity has led analysts to suggest that the asset remains positioned for growth if resistance zones are surpassed.

Hoskinson Responds After Audit Clears Allegations

Founder Charles Hoskinson has faced accusations of mismanaging funds through the ADA Voucher Program. Claims ranged from redirected tokens to manipulated upgrades, with critics alleging he seized $619 million during the 2021 Allegra hard fork.

Hoskinson denied the claims, stating funds were placed in a custodial account during the Token Generation Event.

A 128-page audit conducted by McDermott, Will & Schulte alongside BDO accountants dismissed all major allegations. Findings confirmed that 99.7% of the 14,282 ADA vouchers were legitimately redeemed.

Safeguards ensured misuse was prevented, and distributors violating terms were subject to enforcement.

The report also clarified the fate of the alleged “missing” 318 million ADA. According to auditors, the tokens were moved into reserves after the Byron era. A Post-Sweep Redemption Project was later created to handle any unclaimed vouchers.

Hoskinson Pushes Back at Critics

Hoskinson addressed the audit findings on X, saying he was waiting for apologies. His remarks reflected frustration over accusations that had circulated for months. The independent report countered claims that insiders diverted tokens or tampered with upgrades.

The outcome has placed focus back on Cardano’s fundamentals and market trajectory. With a clean audit outcome and analysts tracking key technical ranges, ADA continues to be closely followed heading into the next cycle.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.