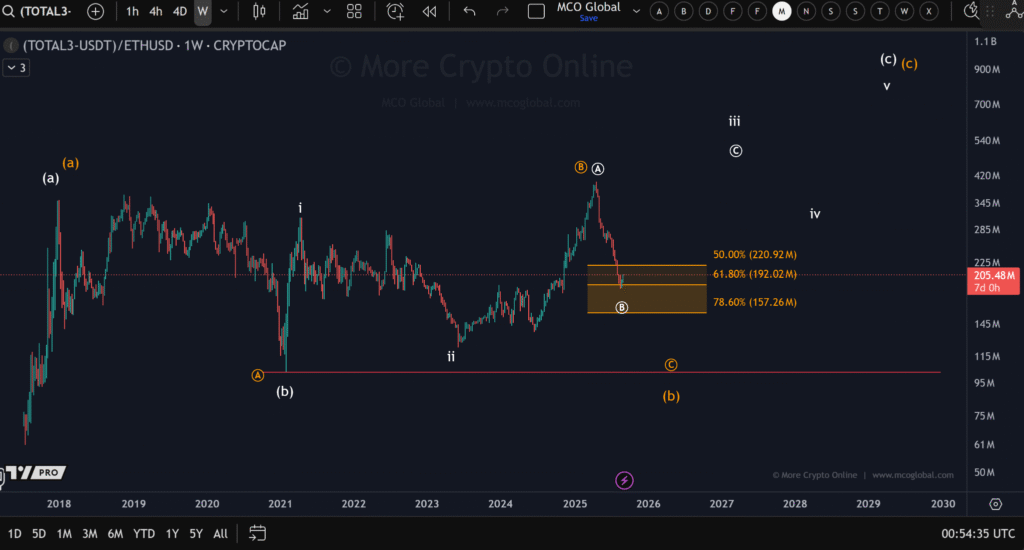

- Altcoins at the Golden Pocket trade between the 50%–78.6% retracement, with $157M as critical support.

- Altcoins indicate strength relative to Ethereum, and this is an indication of capital rotation and better positioning.

- Macro Breakout Zone: A breakout of above 1.1 trillion would catapult the altcoins into a new wave of bullish cycle and failure would lead to consolidation.

The altcoin market cap excluding Bitcoin and Ethereum now trades in a critical golden pocket zone. Altcoins at the Golden Pocket face a decisive moment, as charts suggest a larger impulsive wave could soon develop. Market participants are assessing whether this phase signals a breakout or breakdown ahead.

Wave Structure and Key Levels

The Elliott Wave structure shows altcoins at the Golden Pocket completing a corrective retracement. Price currently trades near the 61.8% Fibonacci level, signaling potential strength for an upcoming move higher. This setup implies Wave (C) could extend strongly upward if support remains intact.

At present, subwaves i, ii, iii, iv, v appear aligned with a projected rally phase. The critical zone lies between the 50% and 78.6% retracement levels, where price action usually defines direction. Altcoins at the Golden Pocket may therefore be preparing for a decisive trend continuation.

However, if the 78.6% retracement near $157M fails, the bullish outlook could weaken. A breakdown below this level opens deeper downside risk, possibly revisiting the $100M region. Altcoins at the Golden Pocket remain balanced between potential breakout and significant breakdown risk.

Relative Performance Against Ethereum

Against Ethereum, altcoins at the Golden Pocket show resilience. Data highlights that their sell-off has been less severe compared to Ethereum’s sharper decline. This relative strength indicates capital flows are rotating toward altcoins.

Technical analysis marks the $157M level as critical support during this retracement. While a short-term low may already be in place, the chance of another dip remains open. Altcoins at the Golden Pocket therefore reflect both resilience and uncertainty in near-term direction.

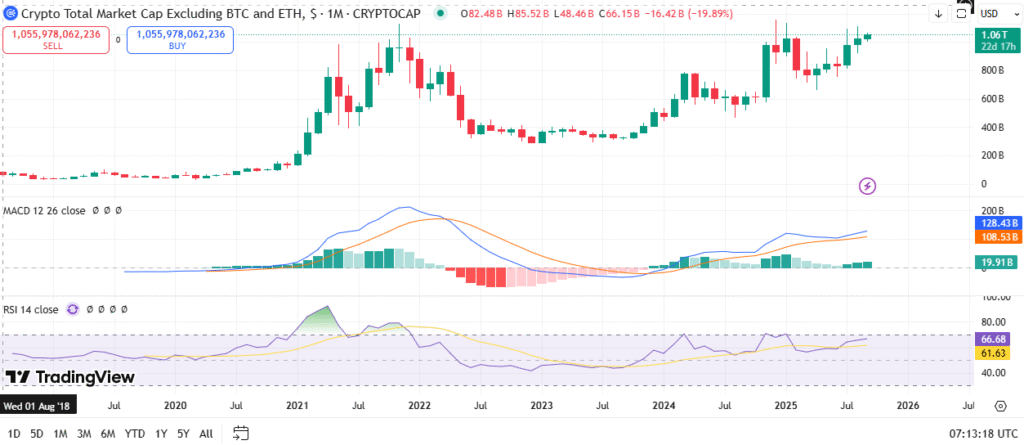

Macro momentum supports the broader view of strength. The monthly chart shows higher lows since 2022 and renewed market participation. Altcoins at the Golden Pocket now face a key test that could define the next phase.

Macro Indicators and Outlook

Momentum signals confirm improving structure across the market. The MACD shows positive territory, while the RSI trends above 60 with upward slope. Altcoins at the Golden Pocket therefore display clear signs of technical momentum.

Source: Tradingview

The broader context shows a long bear phase ending in 2022, followed by stabilization and recovery in 2023. Since then, market cap has grown steadily, now approaching $1.06 trillion. Altcoins at the Golden Pocket stand near the highs of the prior cycle.

The outlook suggests a breakout above $1.1 trillion could trigger sustained growth and possibly new highs. Failure at this resistance, however, may bring sideways consolidation. Altcoins at the Golden Pocket remain at a decisive crossroads.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.