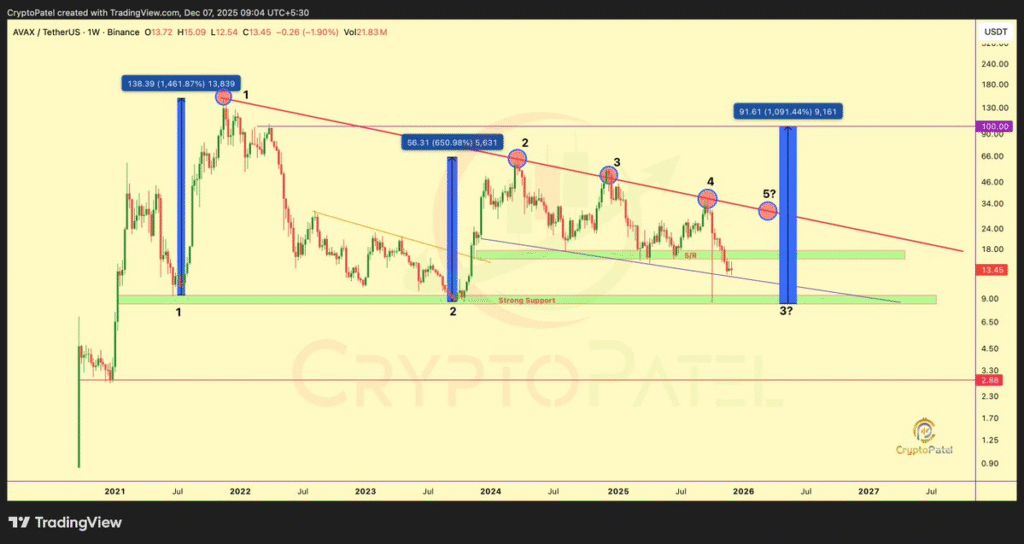

- AVAX faces rejection at $16–$17 resistance, which could lead to a breakout or significant decline.

- Historical accumulation zones at $10–$8 have seen rallies up to +1461%.

- Risk of $AVAX crashing to $3 if support below $8 fails.

Avalanche ($AVAX) is at a crucial point in its price action. With the price testing key resistance zones at $16–$17, traders and analysts are watching for signs of a breakout or potential price drop.

AVAX Approaches Key Resistance Levels: Could Lead to a Major Shift

Crypto Patel, a prominent analyst, recently shared on X that if $AVAX successfully breaks through this resistance, it could spark a move toward $100 or more. However, failure to break above these levels could trigger a decline back to lower support zones.

Resistance at $16–$17 has been a strong barrier for $AVAX in recent weeks. Despite several attempts to push past this range, the price has been unable to sustain above these levels, leading to a period of consolidation.

AVAX Could See Major Upside or Downside Depending on Support

In addition to the resistance at $16–$17, $AVAX’s price is also being influenced by key support levels. Historical price data shows that when $AVAX has tested the $10–$8 range, it has sparked significant rallies.

For example, in 2021, the price increased by over +1461%, and in 2023, it rallied by +650%. These accumulation zones have historically been an ideal buying point for long-term investors, which could lead to substantial gains if the price bounces from these levels again.

However, this pattern also carries risks. If the price fails to hold support at $8, analysts warn that $AVAX could enter a freefall, potentially dropping to the $3–$2 range.

This scenario would represent a severe decline from current levels, making it crucial for investors to monitor the price closely. The next few weeks will be crucial in determining whether $AVAX holds support or faces a deeper decline.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.