- Bitcoin has already re-entered its long-term uptrend, and a mid-term forecast demonstrates a target of $140,000.

- The next significant obstacle is the 119,000-120,000 segment which may be retested at the same level of 123,360, should it be broken.

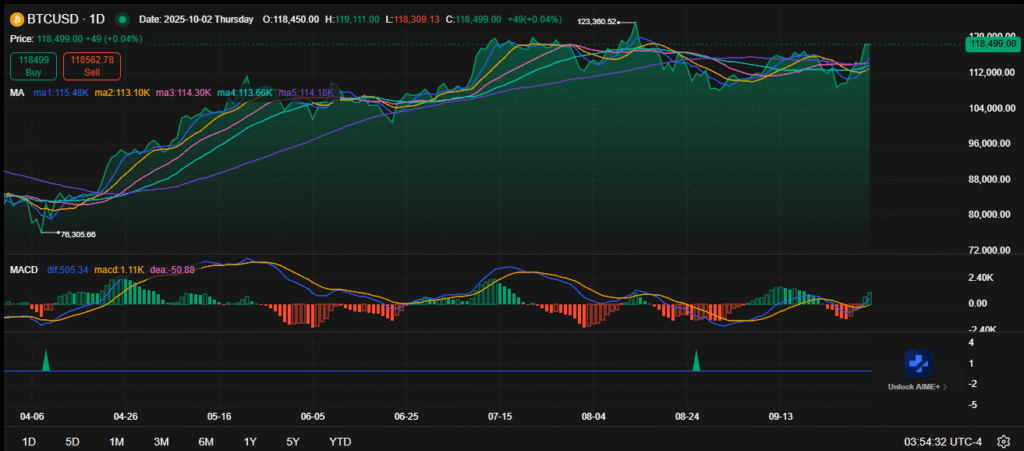

- At $113,000 to 115,000, it cannot be broken and the moving averages and a bullish MACD crossover that supports the upward momentum further.

Bitcoin affirmed an upward breakout of a bullish flag formation and once again began moving upwards in the long run. The price is now trading around at 118,499 following a slight change of about 1.03 percent in a day. Technical forecasts peg the mid term figure to about $140,000 which is a huge prospect at the present.

The breakout pattern is an indication of continuity following the previous consolidation in downward trend lines. Any break above such structure implies new momentum and additional profit. The breakout target is determined by understanding the previous impulse move by the analyst before the formation of the flag.

Although the structure is still good, one can see short-term fluctuations. The momentum may be disrupted by external forces, e.g. macroeconomic changes or liquidity events. However, the confirmation above the break out area keeps the bullish view.

Technical Support and Resistance.

The next decisive test has been reached at the level of the resistance of Bitcoin in the range of 119,000-120,000. Any further strength above this band can open the door to a retest of the new high around the 123, 360. A positive move would be in favor of the mid-term target.

Source: ainvest.com

Support levels remain firm between $113,000 and $115,000, reinforced by several moving averages clustered in this range. Holding above this zone strengthens the bullish structure. The alignment of short and mid-term moving averages confirms higher support levels.

The MACD indicator recently delivered a bullish crossover. The tide has now turned up in favor as the histogram shows reversing purchasing power. These indicators are consistent with the breakout story, and indicate renewal in case the momentum is maintained.

Market Context and Outlook

In 2024, Bitcoin spent most of the year consolidating below 1000 USD before exploding upwards in the last quarter of the year. That action set up a turbulent trading period until 2025. The asset had hit a high of 123,360 and then fell back.

BTC has been making higher lows starting in early September and strengthening its bullish recovery. The structure has the strength of withstanding previous pullbacks. Strength was ensured by the price stability that was over $113,000 ensuring renewed advances.

To conclude, the breakout of Bitcoin ascertains the upward momentum up to 140,000. Key resistance is seen at the level of 120,000 and the 113,000 level serves as the foundation of the case seen as bullish.

Disclaimer: The information in this press release is for informational purposes only and should not be considered financial, investment, or legal advice. Coin Crypto News does not guarantee the accuracy or reliability of the content. Readers should conduct their own research before making any decisions.