- Bitcoin’s price has stayed near $100K despite large ETF outflows.

- Analysts predict a potential bottom near $95K, followed by a rally.

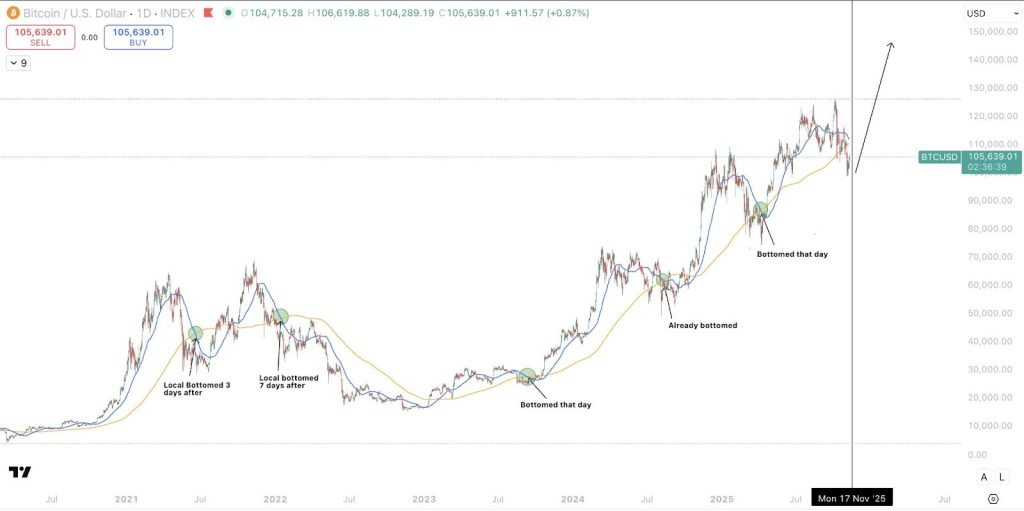

- The upcoming death cross signals a possible local bottom for Bitcoin.

Bitcoin has recently shown signs of stability as ETF flows indicate that the selling momentum may be stalling. With the price holding around the $100,000 region, there has been a noticeable reduction in outflows from Bitcoin-based exchange-traded funds (ETFs), a key indicator of market sentiment.

Daan Crypto Trades points out that when large outflows occur but the price refuses to fall further, it could signal that the market is nearing a potential bullish reversal.

Despite the relatively subdued market, Bitcoin’s price has failed to break higher, suggesting that further upward movement is uncertain for the time being. This situation could indicate a local top, especially if ETF inflows are not substantial enough to push the price up.

The Death Cross and Potential Bitcoin Bottom

Bitcoin’s price action is also being observed in relation to the looming “death cross” pattern, a technical indicator that has historically marked significant local bottoms in the market.

The death cross occurs when the 50-day simple moving average (SMA) crosses below the 200-day SMA, signaling a potential downturn in price. Past instances of this pattern, such as in 2018, 2020, and 2025, have often been followed by strong rallies.

Bitcoin analyst Sykodelic notes that a death cross is expected to form in the next few days, with a potential local bottom near $95K before the price rebounds. According to the analyst, historical data suggests that Bitcoin typically experiences a 45% rally within five days of a death cross.

ETF Flows and Short-Term Market Sentiment

The ETF flow data provides additional insight into Bitcoin’s near-term market sentiment. A significant outflow was seen on November 4, 2025, followed by further outflows throughout the month.

Despite this, the price remained stable, with small upward movements observed in response to other factors. As the death cross approaches, analysts continue to watch how Bitcoin reacts to these inflows and outflows.

While the data does not guarantee future price movement, the market has historically seen price reversals after similar conditions. Some analysts suggest that if the price continues to hover around the $100K level and the death cross confirms the bottom, Bitcoin may be poised for a rally, with some projecting a target of $145K in the medium term.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.