- Bitcoin surged 1.7% to $122,386, approaching a critical resistance zone between $124,000 and $125,000 that could trigger a short-term pullback.

- With $68 billion in 24-hour trading volume and a $2.44 trillion market cap, Bitcoin shows strong liquidity and sustained market participation.

- Despite possible short-term consolidation, Bitcoin’s structure of higher lows and steady accumulation signals continued long-term bullish momentum.

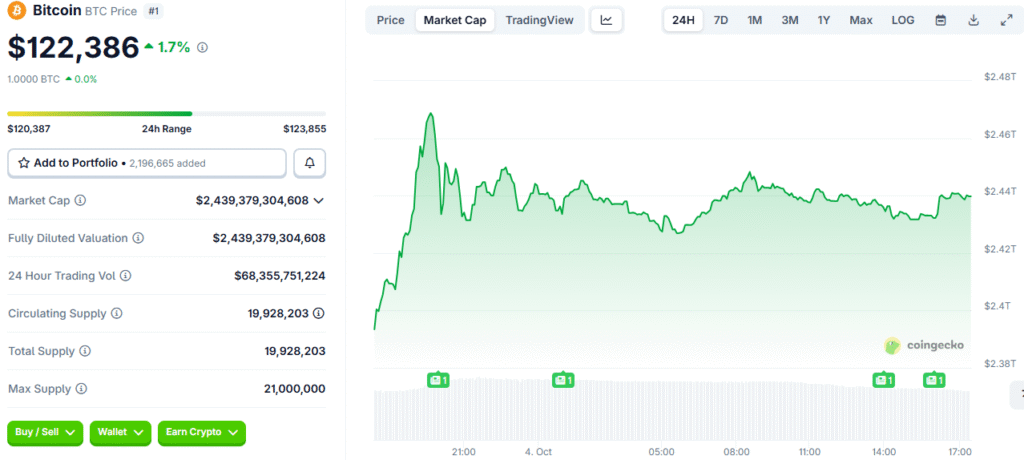

Bitcoin extended its upward momentum, gaining 1.7% over the past 24 hours to trade at $122,386. The rise pushed its market capitalization to $2.44 trillion, reinforcing its dominant position in the digital asset market. However, the price now approaches a key resistance region, suggesting a short-term correction could emerge after recent gains.

Bitcoin’s price action shows a strong uptrend following an extended consolidation period that preceded this latest breakout. The 24-hour range between $120,387 and $123,855 highlights moderate volatility with consistent upward bias. The surge comes with renewed buying pressure as trading volume reached over $68 billion, signaling active participation and strong liquidity.

Despite the bullish tone, market indicators show potential for short-term exhaustion as BTC nears major resistance levels. The chart reveals smaller candle bodies near the top, often a precursor to consolidation or mild pullbacks. Maintaining momentum above $121,000 remains crucial for sustaining the broader bullish structure in the near term.

Market Capitalization and Supply Dynamics

Bitcoin’s circulating supply stands at 19.93 million, nearing its 21 million cap, emphasizing its deflationary appeal. The fully diluted valuation matches the market cap, confirming that nearly all supply is in circulation. This scarcity continues to support Bitcoin’s price stability and long-term growth narrative.

Source: Coingeko

Additionally, Bitcoin’s dominance exceeds 50% of the total crypto market, underscoring its leadership role amid evolving macroeconomic conditions. Trading activity remains steady across global exchanges, providing consistent depth for high-volume transactions. The ongoing institutional participation further strengthens its position as a key digital asset benchmark.

Technical Outlook and Broader Implications

Technically, Bitcoin remains in a bullish structure, supported by higher lows and strong breakout volume. Yet, resistance around the $124,000 to $125,000 zone could prompt temporary profit-taking before any sustained advance. A successful break above this range would likely extend momentum toward new local highs.

On the downside, holding above $121,000 would preserve the bullish setup and confirm structural integrity. Market conditions continue to favor gradual accumulation over speculative surges. Overall, Bitcoin’s resilience and consistent upward trajectory suggest that while short-term corrections may occur, its long-term bullish outlook remains firmly intact.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.