- Bitcoin’s price above $117k means 95% of the circulating supply is now profitable.

- Over 95% of Bitcoin’s supply is in profit as its price surpasses $117k.

- Bitcoin’s recent price surge above $117k signals growing market risk and profit-taking.

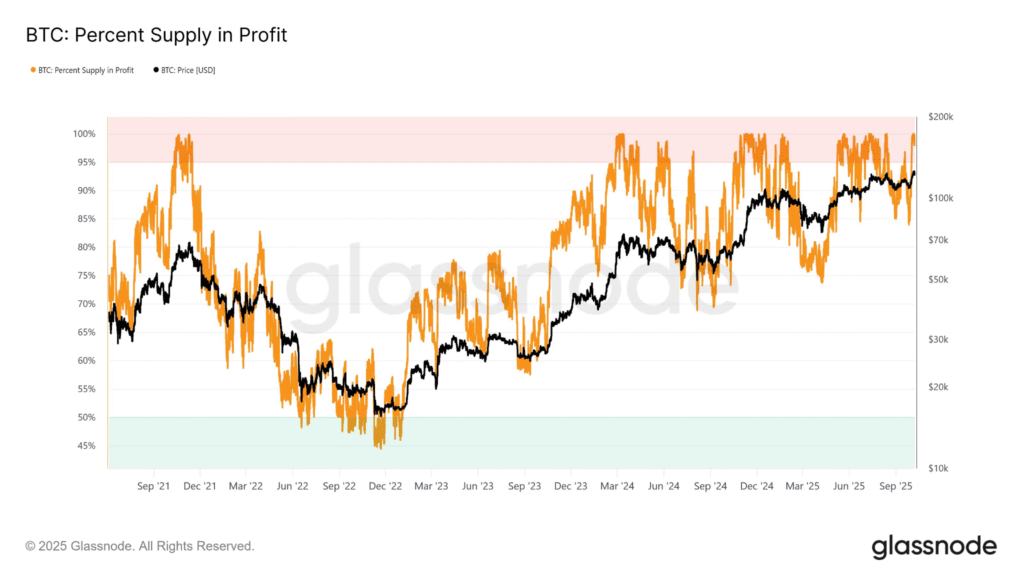

Bitcoin has recently surpassed the $117k mark, a critical price level that has brought over 95% of its circulating supply into a profit zone. Glassnode data show this surge is notable as it reflects a widespread period of profitability for investors, suggesting that many who entered the market during previous lower price points are now seeing significant returns.

With over 95% of the supply now profitable, Bitcoin has entered a phase often associated with euphoria. During such times, the sentiment within the market becomes overwhelmingly positive, which can, however, lead to increased market risk.

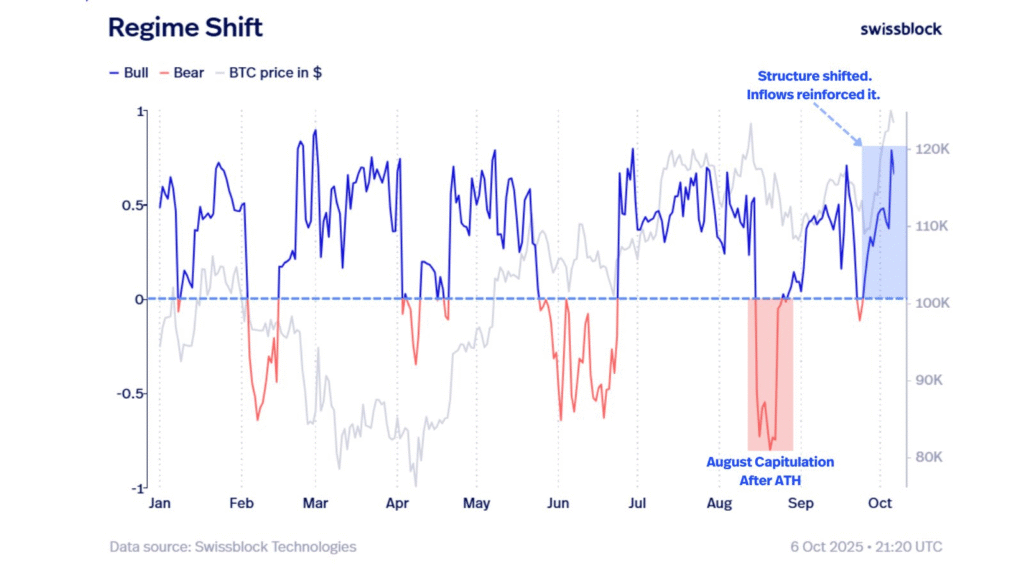

Market Structure and Momentum Reinforce Bullish Sentiment

Bitcoin’s market structure remains resilient within the all-time-high (ATH) zone, reinforcing the prevailing bullish momentum. This alignment between market structure and price action is a strong indicator that Bitcoin’s upward trajectory could continue in the short term.

The market momentum is further supported by a surge in inflows, which strengthens the bullish outlook. As the market is in the ATH zone, Bitcoin is looking solid and will continue to attract investors. Price movement and positive flows are bullish.

Euphoria Phase and Market Risk

Price above $117k means we are in the euphoria phase where a big chunk of the supply is in profit. In these phases the sense of profit takes over and people start taking profits. This behavior increases market risk as many traders and holders want to cash out and get their profits, which can lead to corrections or price pullbacks.

However, Bitcoin price goes up and more people get into profit, there is a chance for market corrections due to profit taking. These cycles of rising price and then corrections are common in the crypto market especially during euphoria. This is why we need to be cautious as we move forward.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.