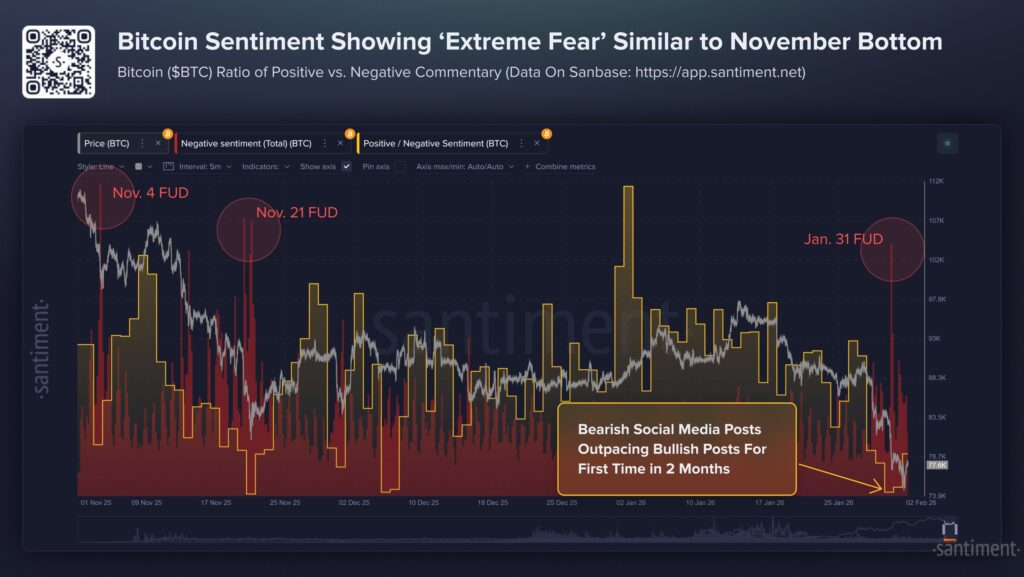

- Bitcoin dropped 16% since Jan 28, hitting $74.6K before bouncing to $78.3K.

- Bearish posts now outnumber bullish ones for the first time in two months.

- Current sentiment is the most negative since the November 21 crash.

Bitcoin has once again entered a phase of extreme fear, echoing patterns seen during previous market lows. As prices dropped by 16% since January 28, retail investors flooded social media with bearish posts. This rising negativity now mirrors sentiment levels last seen in November, hinting at potential short-term market shifts.

Bitcoin Sentiment Turns Bearish Amid January Decline

Bitcoin’s price movement since January 28 has drawn widespread attention, especially after it dropped sharply to $74.6K. According to Santiment data, this 16% decline stirred a rise in Fear, Uncertainty, and Doubt (FUD) across social media platforms. Retail traders reacted quickly, leading to a temporary price rebound back to $78.3K.

Social media platforms saw bearish commentary increasing, while positive posts declined. The data shows that this is the first time in two months that negative posts have outnumbered bullish ones. Analysts at Santiment observed that the volume of negative sentiment is now at levels last seen after the crash on November 21.

The trend appears consistent with past FUD-driven price actions. Bitcoin previously saw extreme social negativity on November 4 and November 21, both followed by price rebounds. The similarity of current market behavior has led many to watch closely for another possible bounce.

“Markets tend to move against the crowd’s mood,” Santiment noted in a post analyzing the current trends.

Market Behavior Reflects Crowd Emotions and Selling Patterns

Retail traders have been selling during the drop, possibly contributing to the rebound, as sentiment worsened. Santiment reported that the latest bounce, while modest, shares key patterns with previous recoveries seen after sharp increases in FUD.

FUD tends to rise when Bitcoin’s price falls quickly, and this pattern has repeated in the past few months. Social data indicates that retail investors are reacting emotionally, pushing out bearish posts during dips, only for prices to stabilize or rise soon after.

Historical trends tracked on Santiment show that extreme fear often coincides with market bottoms. This pattern is currently being watched, as negative sentiment increases while the price attempts to recover.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.