- $112K is the pivot. Acceptance above flips bias and can squeeze price into $114.5K–$118K. Rejection preserves a lower high and favors a pullback toward $109K–$107K.

- Intraday momentum cooled. BTC consolidates near $110K with RSI sub-50 and MACD below signal. Holding the mid-band $110.0K–$110.

- The decision zone overlaps key Fibonacci retraces, so stop runs are likely.

Bitcoin paused beneath a key resistance band after a sharp rebound. The market faces a binary path from this pivot. A breakout targets $114.5k–$118k, while rejection favors $109k–$107k first.

The immediate line in the sand sits near $112k. Acceptance above it would flip bias and unlock higher liquidity pockets. Momentum could then guide price toward $114.5k–$116k, and possibly $118k.

Failure at $112k keeps a lower-high structure intact. Prices would likely rotate toward the $109k–$107k demand band. A daily close below that shelf exposes $105k–$103k risk.

This decision zone overlaps common Fibonacci retraces of the prior slide. Therefore, stop runs on both sides are likely before resolution. Clear higher-time-frame closes should confirm whichever side wins.

Intraday Structure and Signals

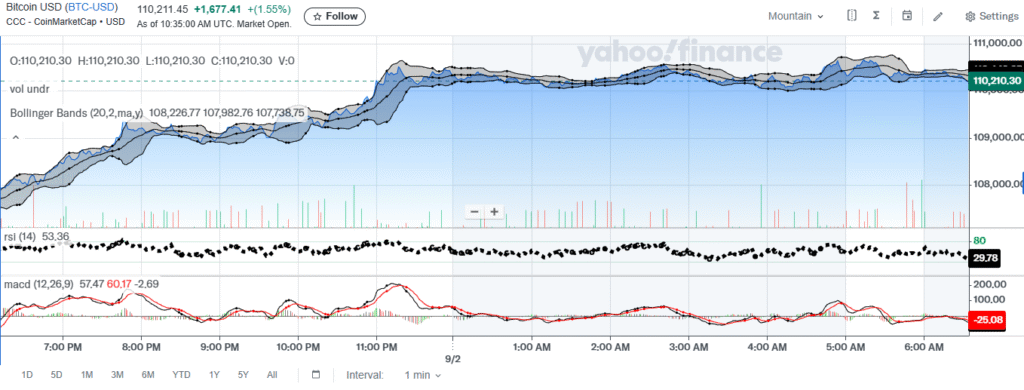

Intraday, price advanced, hugged the upper band, and then cooled. It now consolidates just above $110k as volatility contracts. This behavior fits typical digestion beneath nearby resistance.

Short-term momentum has softened on standard oscillators. RSI dipped toward the low-30s while MACD crossed below its signal. These readings confirm fading thrust after the earlier burst.

Holding the mid-band near $110.0k–$110.1k keeps a retest of $110.6k–$111.0k in play. A break under the lower band and session VWAP opens $109.8k. Below there, $109.3k–$109.5k stands as next supports.

Context and Outlook

The zone under test aligns with the prior breakdown and heavy order flow. In Elliott terms, rejection supports a wave-(2) corrective bounce. Meanwhile, a firm reclaim argues for a larger B-wave advance.

Market structure across L1 and L2 venues remains orderly. Funding and open interest behavior will help filter fake moves. Rising volume during a level reclaim would strengthen the bullish case.

Until price either rejects $112k or accepts above it, range tactics remain practical. Traders may lean on clear invalidation levels and tight stops. Directional conviction returns once the pivot decisively breaks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.