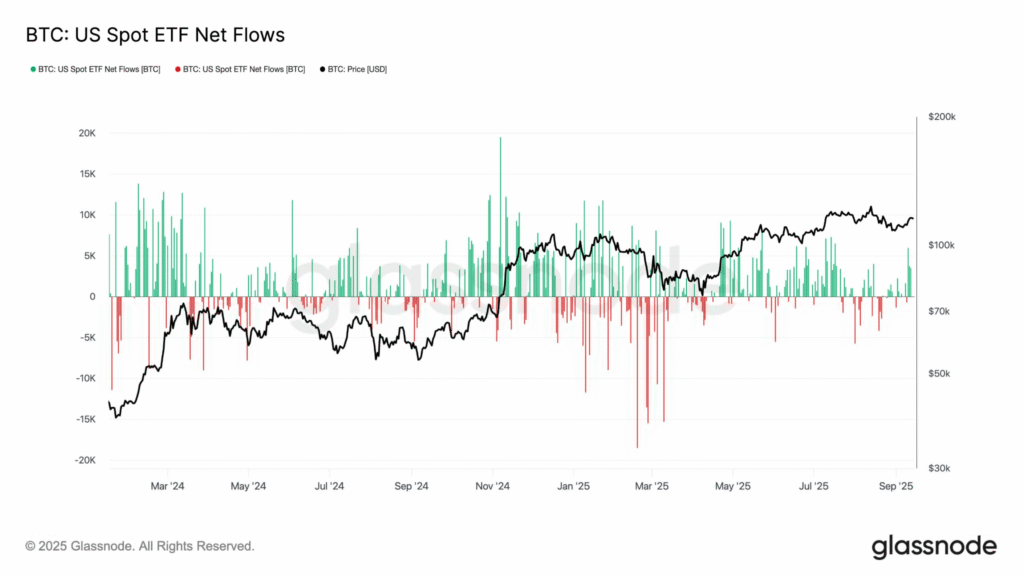

- US Bitcoin Spot ETFs saw 5.9K BTC net inflows on Sept 10, the highest since mid-July 2025.

- Miners reduced BTC exchange flows as price held above $115.9K, reflecting accumulation.

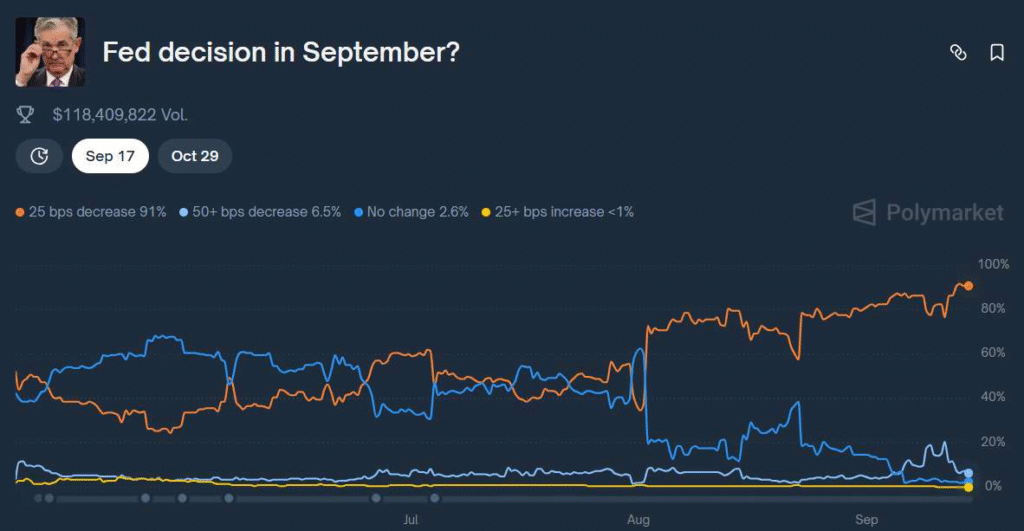

- Polymarket traders show 91% odds of a 25bps Fed rate cut in September 2025.

On September 10, U.S. Spot Bitcoin ETFs recorded net inflows of 5,900 BTC, the highest daily inflow since July 2025, according to Glassnode. This pushed the weekly flows into positive territory after several weeks of mixed movement.

The recent data signals growing interest from institutional investors, especially as the BTC price continues trading above $114,000.

The chart shows green bars for inflows and red bars for outflows, reflecting daily activity over the past year. Notably, inflows appear to rise during price surges, while outflows align with periods of decline.

ETF demand follows price strength, indicating buyers are positioning ahead of further moves. This reflects improved sentiment as the market holds near local highs.

Miners Reduce Exchange Selling as Price Rises

CryptoQuant data shows a visible decrease in Bitcoin miner-to-exchange flows, which suggests miners are selling fewer BTC. These flows are shown on the chart as a green line, and they have trended downward since early 2025.

At the same time, the BTC price remains around $115.9K, creating a backdrop of accumulation. Historically, when miners send fewer coins to exchanges, it means less selling pressure. This often coincides with price support or continued upward movement.

The trend suggests that miners expect higher prices and are holding more BTC rather than distributing it. This behavior supports continued market strength into the final quarter of the year.

Fed Policy Expectations Support BTC Liquidity Outlook

According to Polymarket, traders give a 91% chance that the Federal Reserve will cut interest rates by 25 basis points in September. The likelihood of a 50+ bps cut is just 6.5%, while the odds of no change stand at 2.6%.

These expectations began rising sharply in August and are now firmly priced in. Lower interest rates usually increase liquidity, which is often positive for Bitcoin and other risk assets. Since 2013, Bitcoin has averaged an 84% gain in Q4.

However, analysts note that if the Fed’s messaging is more cautious, or if the cut is already priced in, Bitcoin could face a short-term reaction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.