- Bitcoin’s price now sits lower than its 2015 bottom against gold, signaling possible growth.

- Bitcoin’s current valuation vs. gold is at its lowest point since 2015, showing opportunity.

- Z-Score analysis suggests Bitcoin could experience a surge similar to the 100x gain in 2015.

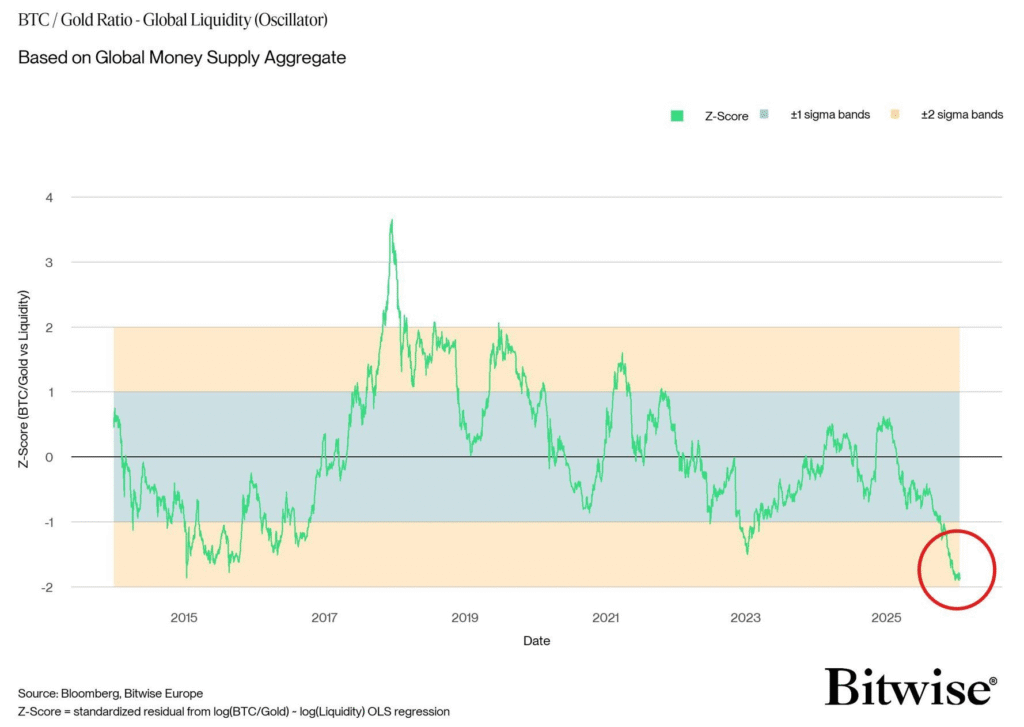

Bitcoin’s current valuation against gold is drawing attention as it falls to a level lower than its 2015 market bottom. According to data from Bitwise and Bloomberg, the Z-Score of Bitcoin relative to gold has dropped to a historical low.

This pattern is similar to the one observed before Bitcoin’s massive growth in 2015, when its price hit a low of $160 before experiencing a 100x surge.

The Z-Score chart, based on global liquidity, highlights the significant decline in Bitcoin’s value compared to gold. Michaël van de Poppe, a well-known crypto analyst, pointed out the current situation, comparing it to 2015 when Bitcoin was undervalued at $160.

The Z-Score has recently reached a new low, suggesting that Bitcoin is currently trading below its intrinsic value compared to gold. This decline could set the stage for future growth, potentially leading to substantial gains.

Bitcoin’s Current Price vs. 2015 Bottom

In 2015, Bitcoin’s price hit an all-time low of $160. Despite this low, the cryptocurrency saw tremendous growth in the following years, with its value increasing by over 100x.

Today, Bitcoin’s valuation against gold is even lower than it was during that period, raising questions about a possible upcoming rally. The current Z-Score reading, which tracks the ratio of Bitcoin’s price to gold, indicates a similar market condition to 2015, where Bitcoin was heavily undervalued.

“The data points to Bitcoin being severely undervalued right now,” said van de Poppe. He noted that if history repeats itself, this could be a moment of significant opportunity for investors, similar to the market conditions seen years ago.

Z-Score Analysis Points to Future Surge

The Z-Score is an important metric used to measure the deviation of Bitcoin’s price from historical averages. A Z-Score that is below -2, as seen in the current chart, typically indicates that the asset is underpriced relative to its historical performance.

With Bitcoin’s Z-Score currently at a low point, analysts believe this could be a sign of an impending price increase, similar to the sharp rise observed in 2015.

Bitcoin’s relationship with gold is often used as a benchmark for the cryptocurrency’s value, as both are seen as stores of value. The sharp drop in the BTC/gold ratio highlights a potential undervaluation of Bitcoin, suggesting it could be poised for a recovery.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.