- Bitcoin’s VDD decline signals less selling pressure from long-term holders.

- Bitcoin price increases 1.7%, crossing $112,500 amid easing market stress.

- $3.8 billion Bitcoin options expiry adds caution to the September outlook.

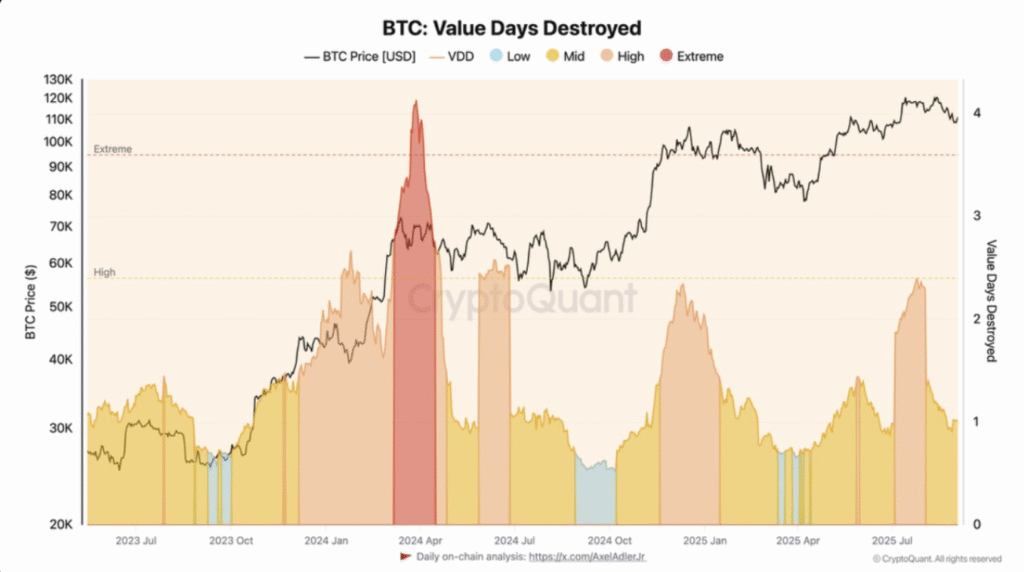

Bitcoin’s on-chain activity has shown positive signs as long-term selling pressure diminishes. According to CryptoQuant, the Value Days Destroyed (VDD) metric is trending lower, indicating that fewer old coins are being spent. This shift in behavior contrasts with April 2024 when long-term holders significantly sold Bitcoin during a price peak near $110,000.

Easing Selling Pressure from Long-Term Holders

CryptoQuant data reveals that Bitcoin’s VDD metric has been steadily declining in recent weeks, reflecting reduced selling activity from long-term holders. In April 2024, the VDD spiked as long-term holders sold large amounts of Bitcoin at the $110,000 price peak.

However, as this trend has begun to subside, there is a noticeable decrease in market stress. CryptoQuant analyst Darkfost_Coc emphasized that if this decline continues, the market could see renewed upward movement. However, such a move would require sufficient demand to support it.

September’s Options Expiry and Market Sentiment

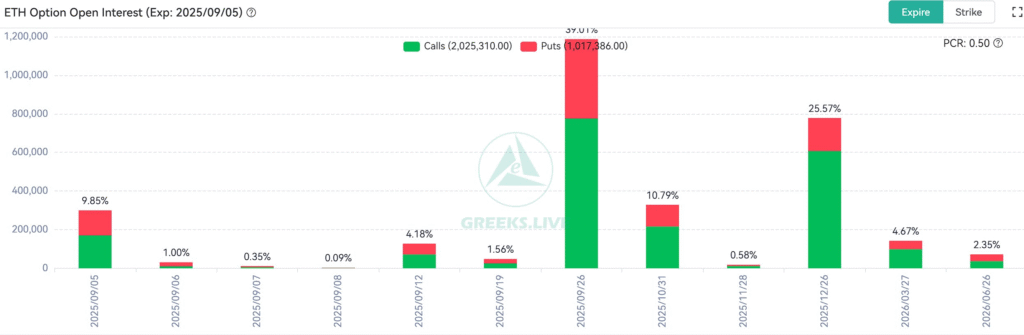

Despite the easing selling pressure, September brings added uncertainty to Bitcoin’s market outlook. Analysts from Greeks.live noted that September is historically a weak month for cryptocurrencies, with factors like institutional rollovers and quarterly settlements often reducing capital inflows.

Bitcoin leads the cycle of expiring options in September, with $3.8 billion in options set to expire, creating a cautious atmosphere. This uncertainty is reflected in the options market, where the put-call ratio sits at 1.41, signaling a bearish sentiment.

In addition, Bitcoin’s implied volatility (IV) has climbed back to around 40%, following a month-long correction that saw its price fall over 10% from its all-time highs. Traders are demonstrating caution, as evidenced by a surge in put options, which account for nearly 30% of today’s total options volume.

While Bitcoin has recently gained 1.7%, crossing the $112,500 mark, analysts like Rekt Capital are closely watching the $113,000 price level. A successful retest or daily close above this price could confirm Bitcoin’s breakout, potentially fueling further upward momentum.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.