- Pineapple Financial secures $100M for a Digital Asset Treasury strategy, boosting Injective’s institutional relevance and visibility.

- PAPL trading volume surged near $500M in September, underscoring rapid adoption of blockchain-based treasury solutions.

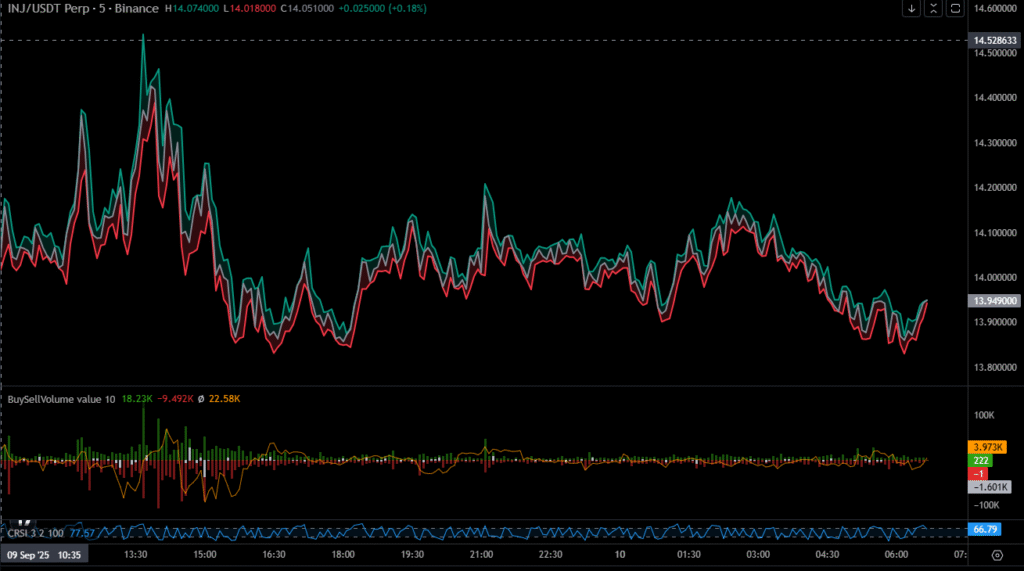

- INJ consolidates between $13.80 and $14.50, with resistance at $14.50 marking a pivotal breakout level.

Blockchain treasury adoption recorded a notable step forward as Pineapple Financial secured $100 million to launch a Digital Asset Treasury strategy. The company selected Injective as the platform for implementation, reinforcing the network’s position in institutional blockchain solutions. Trading volumes confirm that demand is building as new capital enters the sector.

Blockchain Treasuries Expand

Pineapple Financial’s plan signals a broader push toward blockchain-native treasury strategies. The $100 million allocation provides resources for scaling operations and building credibility. Blockworks Research has tracked activity, showing the firm’s rising presence in the digital asset treasury market.

PAPL trading volumes reflected strong growth in recent weeks, climbing sharply during September and reaching highs near $500 million. This rapid acceleration shows that treasury strategies in crypto markets are attracting measurable attention. Consequently, the broader landscape for blockchain treasuries now demonstrates clear signs of institutional participation.

Injective gained recognition as one of the few platforms with official Digital Asset Treasury analytics. This strengthens its reputation in providing infrastructure suited for large-scale adoption. Moreover, Pineapple Financial’s involvement adds weight to Injective’s growing ecosystem.

INJ Faces Resistance

The INJ perpetual futures chart highlights short-term fluctuations between $13.80 and $14.50. Price spikes occurred early before momentum cooled and consolidation followed. As a result, the market settled near the $14 level with neither side in control.

Source: Coinanalyze

The Buy/Sell Volume indicator recorded heavy green buying during peaks, but later sessions saw red selling pressure pulling prices lower. Mixed activity in recent hours confirms a balance between demand and supply. Therefore, consolidation continues while markets assess direction.

Momentum indicators place INJ near moderately bullish levels, with CRSI around 66.79. However, the token has not crossed extreme thresholds. A breakout above $14.50 could signal renewed strength, while losing $13.80 risks further downside moves.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.