- BNB dropped 7.13% in 24 hours to $819.83 after reaching $876.70.

- Analysts expect BNB to reach $2,300 this cycle based on historical patterns.

- Key support near $793.70 holds as BNB retests broken trend line.

Binance Coin (BNB) experienced a steep 24-hour price drop of 7.13%, bringing its value down to $819.83. The fall comes after BNB reached a short-term high of approximately $876.70. Despite the decline, several analysts suggest that BNB remains within a long-term bullish setup.

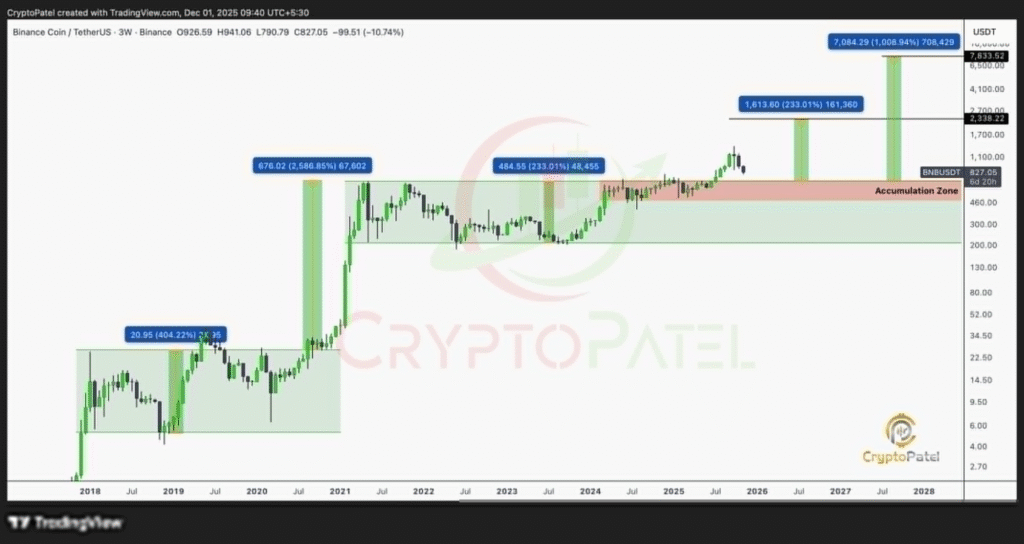

Crypto Patel, a well-followed digital asset analyst, commented that BNB continues to show a bullish breakout pattern. He pointed to historical cycles where accumulation zones led to strong rallies of over 2,000%.

Patel has marked the current accumulation zone between $700 and $500. He referred to this price range as a “crazy discount entry,” if it is revisited.

He expects the current cycle to reach as high as $2,300. The forecast is based on past breakout behavior and accumulation ranges that preceded sharp uptrends.

Trend Line Breakout and Support Levels in Focus

Another analyst, Hardy Degen Hardy, noted that BNB has followed a classic breakout and retest setup. According to Hardy, a long-term descending trend line was broken recently, and price action pulled back to retest this level.

He also identified a support zone near $793.70 USDT, which has held through the recent correction. “This level has been tested and respected,” Hardy mentioned on social platform X. He added that price holding above this level may set the stage for strength in the coming week.

Historical Accumulation Zones Guide Market Outlook

The historical pattern of accumulation and rally in BNB’s previous market cycles remains a key point for analysts. Patel noted that past cycles saw extended periods of sideways trading followed by steep upward trends.

The $700–$500 zone is being monitored as a potential re-entry level if prices continue to decline.

BNB’s current price action is being analyzed within the framework of both technical support and historical behavior. While short-term volatility remains, some analysts maintain that the broader cycle trend remains upward.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.