- BNB’s $117.91B market cap surpasses Nike, driven by institutional adoption.

- The token’s utility in payments, staking, and governance fuels its 2025 rally.

- An auto-burn mechanism and $1.2B in potential treasury investments enhance value.

BNB, the native token of the BNB Chain, has solidified its position as a powerhouse in the cryptocurrency market, surpassing Nike’s $110.61B market cap with a staggering $117.91B valuation, as highlighted by Binance’s recent X post.

Analyst Ali (@ali_charts) has expressed a bullish outlook on $BNB, citing its growing adoption by public companies, sovereign funds, and even treasury arms, with some holdings reaching hundreds of millions.

This institutional interest, including Abu Dhabi’s recent $681.5M Bitcoin ETF investment, signals a broader shift toward mainstream crypto acceptance. BNB’s utility underpins its meteoric rise. Beyond being a tradable asset, it powers payments, staking, and settlements on the BNB Chain, which transitioned to its mainnet in 2019.

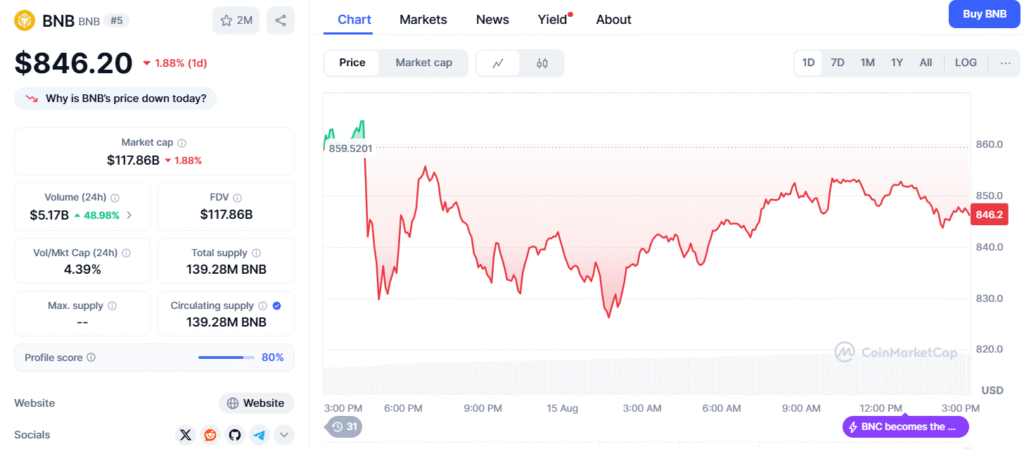

The token also serves as a governance tool, allowing holders to influence the ecosystem’s direction. Current CoinMarketCap data reflects a live price of $849.01, with a 24-hour trading volume of $5.1B, ranking it #5 globally. Its performance as a top altcoin in 2025, breaking new all-time highs, underscores a phase of price discovery driven by real-world use cases rather than speculation.

The BNB Chain’s leadership in decentralized exchange volume—peaking at over $108B weekly—further bolsters its credibility. An auto-burn mechanism reduces the total supply to 100 million BNB, enhancing scarcity and value predictability. Forbes notes that over 30 companies are exploring “BNB Treasury” strategies, with $1.2B in potential buying pressure, marking its transition to an institutional-grade asset. Staking opportunities also allow users to earn rewards while securing the network, making $BNB a multifaceted investment.

For investors, owning BNB is akin to holding a stake in Binance’s ecosystem, blending utility with growth potential. As institutional adoption grows and the token’s ecosystem expands, Ali’s optimism seems well-founded, positioning $BNB as a cornerstone of the blockchain-integrated economy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.