- BONK rebounded from the 50%–78.6% retracement zone, forming a base for potential upside continuation.

- A higher high is required to validate wave c, with Fibonacci targets between 123.6% and 161.8%.

- BONK holds above moving averages while reduced volume suggests quiet accumulation before a possible breakout.

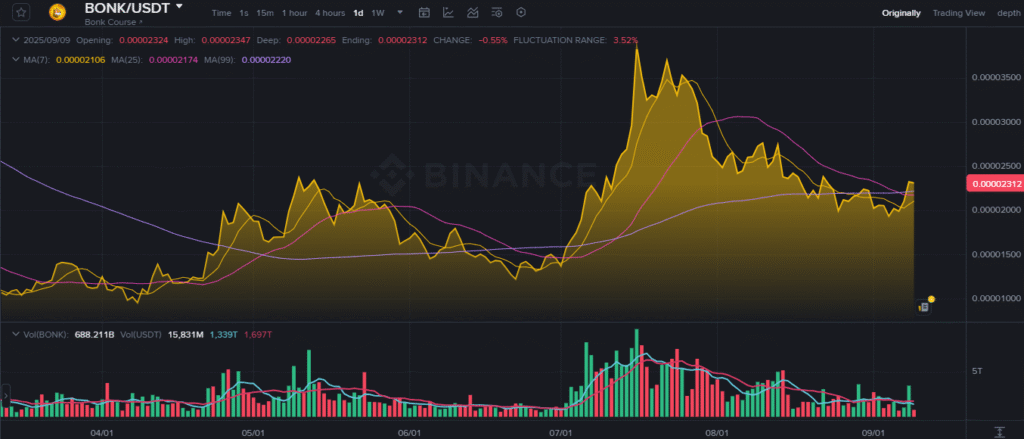

BONK has reached a critical phase as price patterns indicate consolidation after a rally and retracement cycle. The token trades around 0.00002312 USDT while technical indicators highlight stability. Market activity shows that momentum could be preparing for another directional move in the coming sessions.

Fibonacci Support Reaction

BONK honored major Fibonacci retracement levels of 50-78.6 percent that usually act as reversal zones during corrective phases. The rebound of this level indicates that demand has returned and stopped the further falls and made price action stable. This development marks an important foundation for potential upside continuation.

Current wave structure indicates an a-b-c correction with a three-wave bounce already completed. Elliott Wave principles suggest that a full bullish impulse requires five waves. Therefore, the market still waits for confirmation of a new higher high.

For confirmation of wave c to the upside, BONK must record another significant high above recent levels. Fibonacci extension targets between 123.6% and 161.8% provide clear checkpoints for possible continuation. These targets will help determine if a sustained bullish phase has begun.

Moving Averages and Market Trend

The daily chart shows BONK consolidating above critical support levels near 0.00002000 USDT after peaking in mid-July. The 7-day and 25-day moving averages currently trade below price, offering short-term support. The 99-day moving average also underpins longer-term structural stability.

Source: Binance

Volume levels have reduced since the July peak, showing less speculative pressure in recent weeks. Despite lower volume, intermittent green spikes highlight possible accumulation activity. This behavior indicates that some market participants may be building positions during consolidation.

The overall setup shows BONK preparing for its next breakout phase. Holding above moving averages strengthens the case for renewed upside momentum. Failure to maintain support could expose the token to deeper retracement levels.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.