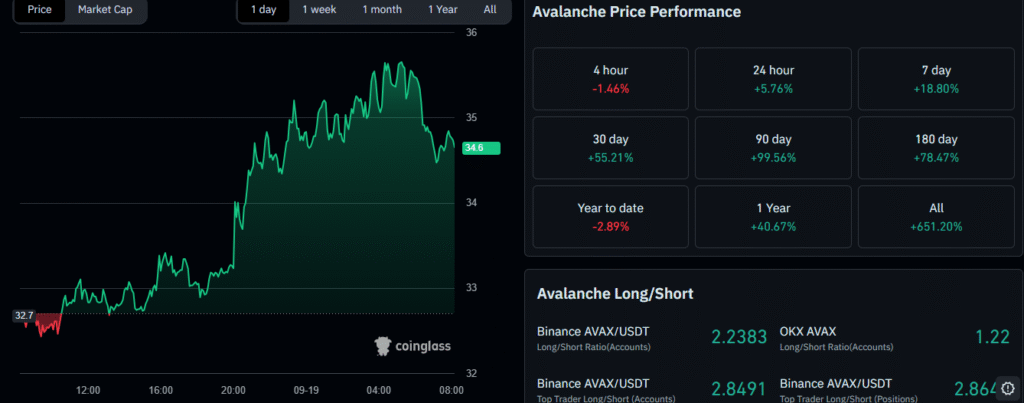

- Avalanche ($AVAX) breaks past $34 with strong momentum, setting sights on $37 as the next critical resistance.

- Performance surges across all timeframes, with 30-day gains above 55% and 90-day performance nearly doubling in value.

- Trader sentiment leans heavily bullish, as long/short ratios on Binance approach three-to-one in favor of long positions.

Avalanche continued its upward rally as the token broke past key resistance levels and moved closer to its next target. The asset climbed above $34, supported by strong buying pressure and consistent bullish momentum across major exchanges. Market participants now anticipate a test of the $37 level, which stands as a critical resistance zone.

Technical Breakout and Price Action

AVAX gained strength after breaking the $27 barrier and extended its move toward $32 before pushing beyond to $34. The latest charts indicate higher lows, confirming a positive structure and a bullish breakout pattern. Momentum remains intact as long as the price holds above immediate support near $34.

Price action has also reflected volatility, with intraday spikes reaching close to $36 before a minor retracement. The consolidation near the mid-$30 zone shows that bulls continue defending recent gains. A successful move beyond $37 could open room for further upside.

Support zones remain clearly defined, with $27, $22, and $18 serving as key fallback levels if momentum fades. These levels provide critical areas for price stability during any corrections. Traders remain attentive to the balance between continued buying and potential profit-taking pressure.

Performance Metrics and Market Context

The token displayed strong growth, with monthly performance rising over 55 percent and 90-day gains nearly doubling in value. Over the past 180 days, AVAX advanced more than 78 percent, highlighting consistent recovery from earlier declines. On a yearly basis, the asset shows an increase above 40 percent.

Source: Coinglass

Long-term data highlights significant expansion, with total growth surpassing 650 percent since early trading history. This context reinforces the strength of the current rally despite past volatility. Year-to-date performance remains slightly negative, reflecting setbacks during earlier months of 2025.

Momentum now positions AVAX among the stronger performers in the digital asset space. Its resilience continues to attract bullish positioning and signals ongoing confidence in price appreciation. The performance backdrop creates favorable conditions for potential upside continuation.

Long/Short Ratios and Trader Positioning

Data indicates a clear dominance of long positions across leading platforms, particularly on Binance. The long/short ratio shows over double the number of accounts positioned long compared to short. Top traders lean even more strongly bullish, with ratios approaching three-to-one.

OKX data shows long positioning as well, though less aggressive than Binance levels. This distribution underscores that the broader sentiment remains supportive. The ratio still reflects majority confidence in near-term appreciation.

Overall, market dynamics suggest continued bullish bias, but heavy long positioning could magnify volatility if momentum weakens. Traders continue to focus on the $34 support and $37 resistance range. Breaking past $37 would likely confirm further strength in Avalanche’s upward trajectory.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.