- TD Sequential sell signal flags potential $ADA pullback on 4-hour chart.

- Historical data suggests 10-15% recoveries post-pullback for Cardano.

- FOMC remarks add volatility, influencing current market sentiment.

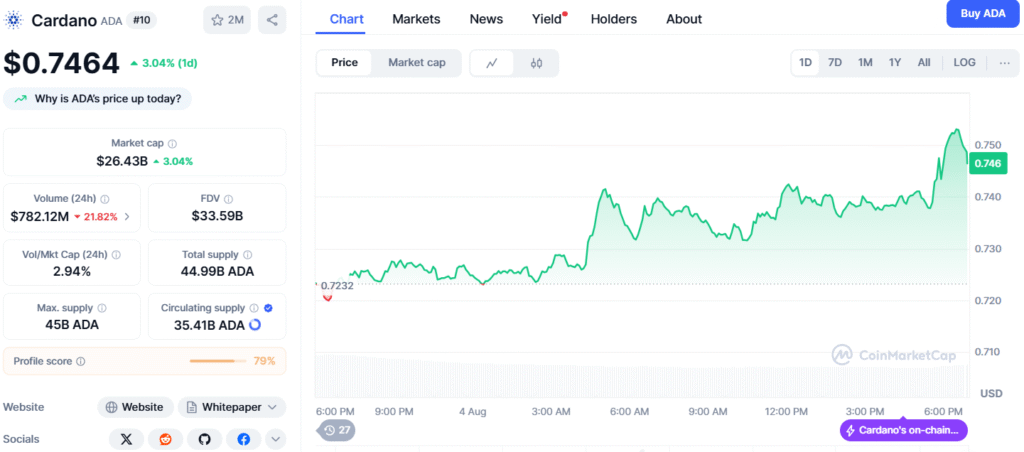

Cardano ($ADA), the third-generation blockchain known for its research-driven approach, is under scrutiny today as technical analyst @ali_charts flagged a TD Sequential sell signal on its 4-hour chart.

Posted on X, the analysis, accompanied by candlestick charts, suggests a potential pullback following recent price gains. The TD Sequential, a tool developed by Tom DeMark, is renowned for identifying trend exhaustion, with a 2018 Journal of Technical Analysis study citing a 70% accuracy rate when paired with volume analysis. This signal comes amid heightened market volatility, influenced by hawkish remarks from the Federal Open Market Committee (FOMC) reported on August 4, 2025, impacting crypto inflows.

The charts reveal a downward arrow, indicating a short-term decline, but historical data from TradingView (2020-2025) offers a counterpoint. $ADA pullbacks have often preceded 10-15% recoveries, suggesting this could be a buying opportunity for savvy investors rather than a sustained downturn. Founded by Charles Hoskinson in 2015, Cardano’s price movements are frequently tied to its smart contract ecosystem and market sentiment shifts, as noted in a 2024 Blockchain Research Institute report. The current signal aligns with broader market dynamics, including a cautious outlook following recent FOMC statements.

Community reactions on X vary. @Cryptophantom_y ponders short setups or profit-taking, while @1ncrypto warns of price “tricks” before dips, reflecting the uncertainty. Despite the sell signal, some traders, like @Joh_Park, question if a spot buy remains viable, highlighting the speculative nature of crypto trading. With Cardano’s volatility historically peaking during NFT booms, as per Statista, this pullback could be a temporary correction in an otherwise resilient asset.

Investors are advised to monitor volume trends and FOMC developments closely. While the TD Sequential suggests caution, Cardano’s track record indicates potential for a rebound, making this a critical moment for traders.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.