- Cardano processes over 115 million transactions on its mainnet.

- ADA approaches key $0.54 support zone signaling a potential rebound.

- ETF inclusion boosts institutional exposure and investor confidence.

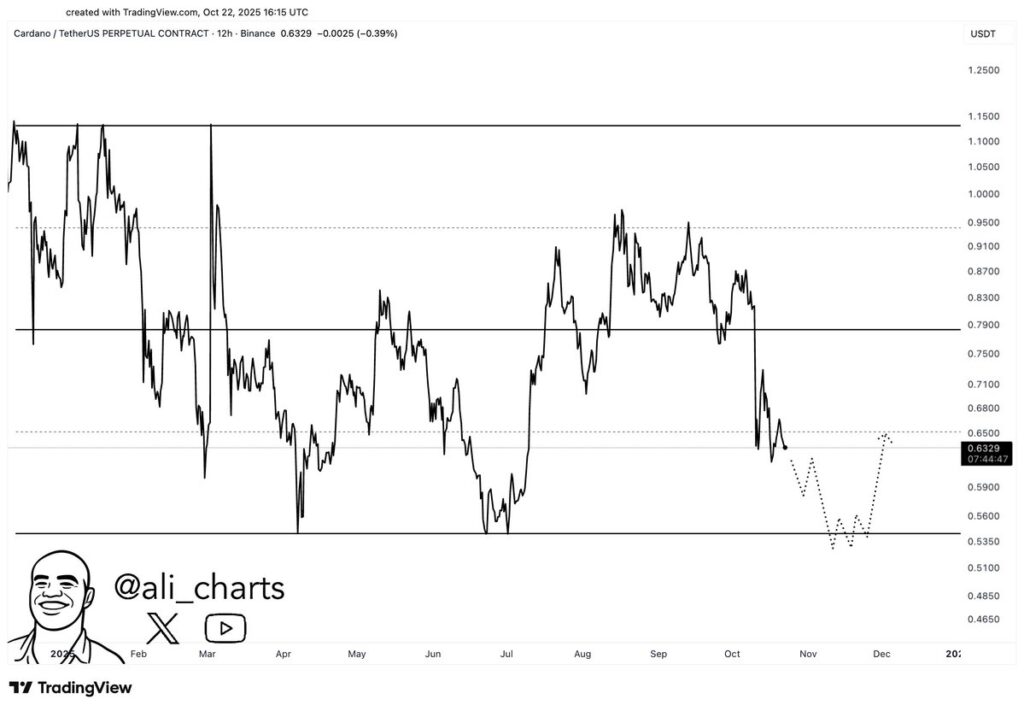

Cardano ($ADA) may be nearing a crucial buy opportunity, according to analyst Ali Martinez. Martinez shared a 12-hour ADA/USDT chart showing a potential reversal zone near $0.54.

The price could decline toward this level before rebounding in late November. Historically, $0.54 has acted as a strong support region for ADA.

Traders are closely watching for confirmation signals that could indicate the start of a recovery phase. If buying pressure intensifies around the support level, ADA could experience renewed momentum in the coming weeks.

Cardano Surpasses 115 Million Transactions

Cardano has officially processed over 115 million transactions on its mainnet, reflecting its consistent growth and usage. The milestone highlights the platform’s ongoing adoption and network stability after more than eight years of continuous operation.

Community members celebrated the achievement on social media. Cardanians, a Cardano-focused X account, wrote, “Another major milestone for Cardano (ADA). Cardano processed over 115 million transactions on the mainnet. It’s here for you 24/7 for 8+ years.”

Since its launch in 2017, Cardano has progressed through various stages, starting with the Byron era under the Ouroboros Classic proof-of-stake mechanism. Early wallet integrations like Daedalus and Yoroi also helped expand the network’s usability and ecosystem.

ETF Inclusion Strengthens Institutional Confidence

Cardano ($ADA) was recently included in the ProShares Trust Index ETF, according to a post by MinswapIntern. The move has been viewed as a major step toward increasing institutional visibility for ADA.

Analysts such as Sssebi and Ali Martinez noted that the ETF listing could attract institutional inflows and strengthen investor sentiment. Traders view this as a pivotal moment that may drive ADA’s next growth phase, as more institutions explore blockchain-backed assets.

With technical, on-chain, and institutional developments aligning Cardano remains one of the most closely watched assets in the mid-cap sector of the market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.