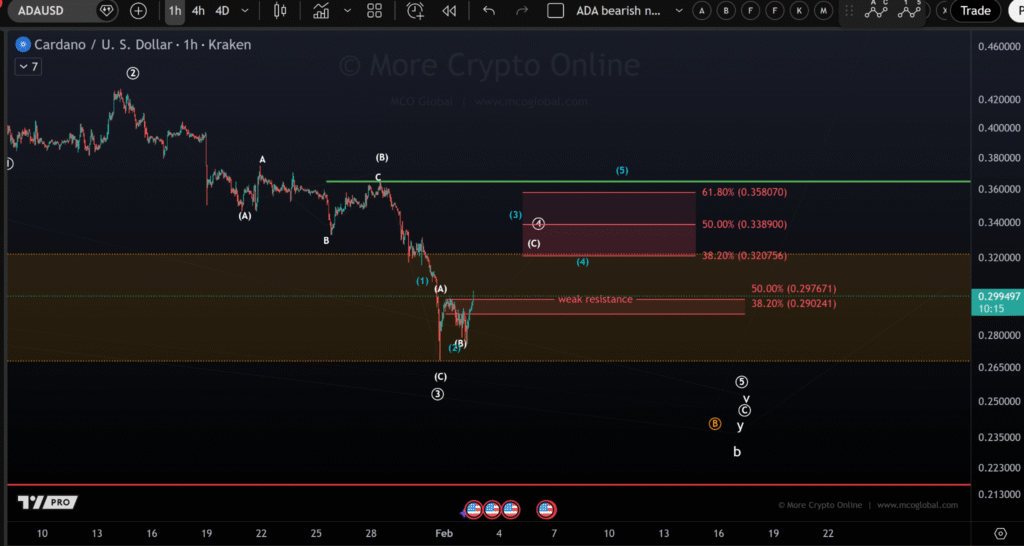

- ADA rebounded from $0.267 and broke through initial weak resistance at $0.29.

- Price action aligns with a potential unfolding wave 4 correction structure.

- Traders now watch the $0.32 to $0.358 zone for further confirmation.

Cardano is showing early recovery signs after bouncing from the $0.267 support level and breaking above a weak resistance zone. Traders are now watching the $0.29 level closely, as continued momentum could indicate a developing corrective wave pattern and open the path toward the next resistance between $0.32 and $0.358.

Cardano Rebounds From Key Support and Tests Initial Resistance

Cardano (ADA) has shown early signs of a short-term recovery after hitting a low near $0.267. According to chart data shared by More Crypto Online via TradingView, ADA recently moved into a resistance area near the $0.29 level.

This move followed a period of downward pressure. ADA found support at $0.267 and began testing a weak resistance zone. The initial breakout above this zone suggests improving market strength, but traders remain cautious.

The $0.29 resistance zone is seen as minor. If ADA maintains upward momentum, the next area of interest lies between $0.32 and $0.358. Short-term recovery potential will depend on continued volume and price support above the breakout level.

Wave Structure and Recovery Outlook Remain Under Watch

The price action is now being assessed in the context of a possible corrective wave 4. More Crypto Online noted that the break above resistance increases the chance that a wave structure is unfolding.

If the pattern holds, ADA could continue higher before facing stronger resistance. The wave formation would represent a temporary recovery within a broader corrective cycle, not a full reversal.

Traders are watching to see if ADA can stay above the current resistance zone. Price confirmation in the next few sessions will be key to validating the pattern.

The ADA chart also shows Fibonacci levels between $0.297 and $0.358, which may act as future resistance. These levels align with previous price reactions, adding further technical relevance to the current move.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.