- Chainlink risks a sharp decline to $4-$5 if support at $10-$11 breaks.

- Head and Shoulders pattern indicates significant downside if support fails.

- A conservative target for Chainlink is $7.15 based on the POC level.

Chainlink (LINK) is facing a bearish outlook with a potential downside to $4-$5 if key support at $10-$11 breaks. The development of a Head and Shoulders pattern signals a possible decline. If $LINK fails to hold the $10-$11 support, further drops to $7.15 or lower could follow.

Chainlink Faces Major Downside Risk Amid Bearish Pattern

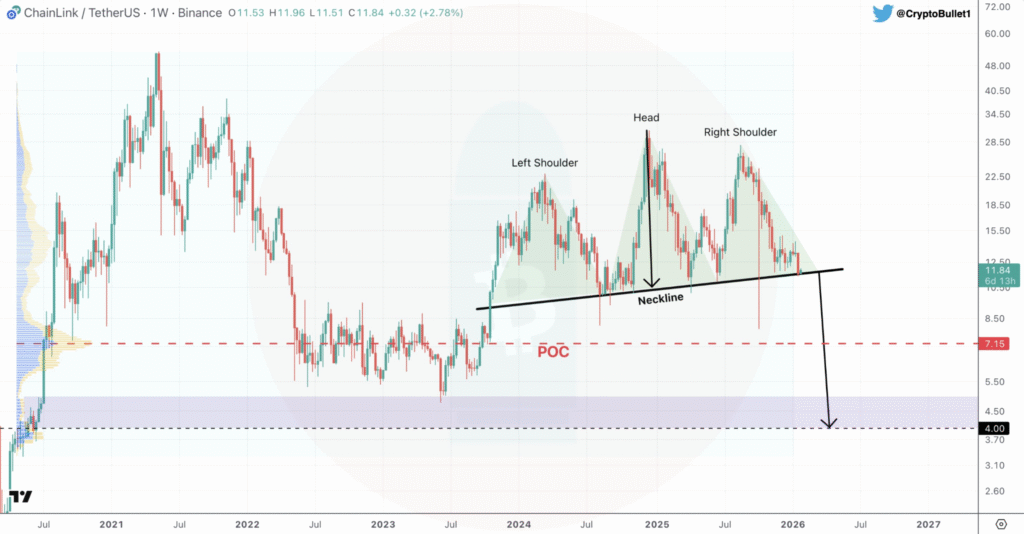

Chainlink (LINK) is showing signs of a bearish trend on its 1-week chart. Crypto analyst CryptoBullet highlights the development of a Head and Shoulders pattern, a technical indicator that often signals a potential price decline.

The pattern’s neckline is currently around $10-$11, and if Chainlink breaks this crucial support level, it could trigger a significant sell-off. According to the analysis, the downside target for LINK could be as low as $4-$5, which would represent a major loss for holders.

This bearish outlook has raised concerns within the community, especially for long-term investors who have relied on the strength of Chainlink. While the $4-$5 downside is considered the worst-case scenario, CryptoBullet also points to a more conservative target at $7.15.

This level aligns with the Point of Control (POC) on the Volume Profile Visible Range (VPVR), which represents an area of high trading activity in the $LINK market. The $7.15 mark is seen as a key support level, and its breach could signal further declines.

Chainlink’s Support Levels Under Scrutiny

The price of $LINK is currently hovering near critical support levels, with the $10-$11 range acting as a key threshold. Should Chainlink fall below this support zone, the bearish pattern would likely be confirmed, leading to a further drop in price.

The next immediate target would be the $7.15 level, which has been a significant accumulation zone for $LINK in 2022 and 2023. If Chainlink fails to hold these levels, the $4-$5 downside target will become increasingly probable, putting additional pressure on its market stability.

Despite these bearish indicators, Chainlink’s supporters are still hopeful for a price reversal. However, without a solid reclaim of the $10-$11 support range, the risk of further downside remains a concern for traders and investors.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.