- DOGE daily RSI breaks downtrend while price moves above key trendline

- DOGE ETF by REX and Osprey to trade under ticker DOJE next week

- TD Sequential shows short-term sell signal with support near $0.219

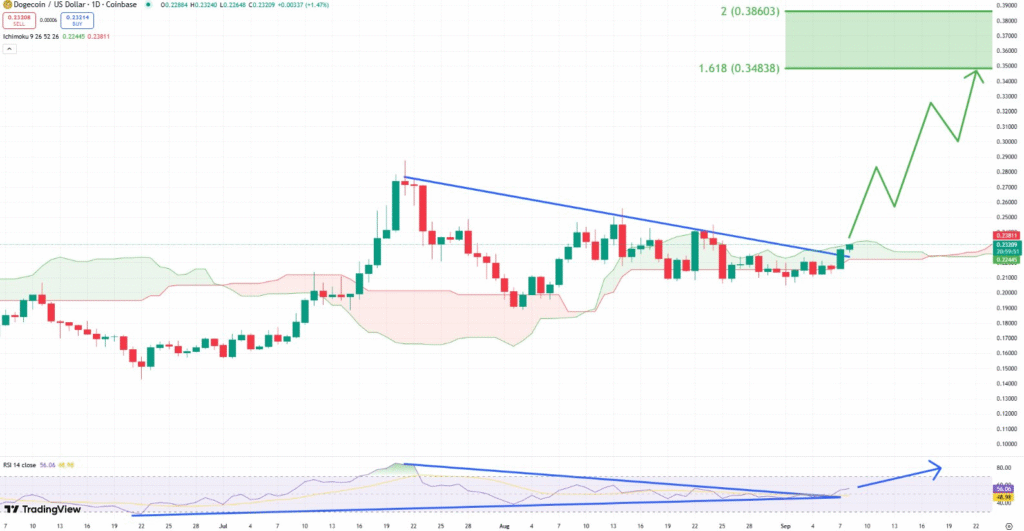

Dogecoin ($DOGE) is showing early signs of a potential price breakout. The daily Relative Strength Index (RSI) has broken out of its previous downtrend, and the price is currently trading above a descending trendline. These movements are being seen as possible signals of bullish strength returning.

At the same time, Dogecoin’s price is approaching a breakout above the daily Ichimoku cloud. Traders often use this indicator to determine momentum and trend shifts. A move above the cloud would suggest the possibility of a sustained upward trend.

Technical strategist Chris noted that the current chart setup supports a target of $0.35, with Fibonacci levels at $0.348 and $0.386. These levels are seen as key zones where momentum could continue if current support holds. However, traders are also being cautious about short-term volatility.

Short-Term Resistance Emerges After Rally

While Dogecoin shows long-term upside potential, it also encounters short-term resistance. According to analyst Ali Martinez, the 4-hour chart shows that $DOGE recently hit $0.232 but is now pulling back. The TD Sequential indicator has issued a sell signal, which may suggest a temporary pause or consolidation.

Current technical levels show resistance at $0.236, while support lies at $0.226 and $0.219. Traders are watching these zones to determine if Dogecoin will maintain upward momentum or face a larger pullback. Short-term fluctuations are common after sharp rallies, especially as traders take profits.

ETF Launch Could Drive Institutional Interest

Another key development is the expected launch of the first Dogecoin-focused exchange-traded fund (ETF). REX Shares and Osprey Funds are preparing to launch the ETF under the ticker DOJE. The fund will offer exposure to Dogecoin through a regulated investment vehicle.

The ETF is expected to launch next week and may increase liquidity and access for institutional and retail investors. While some caution remains due to Dogecoin’s price volatility, many analysts view the fund as a potential driver for wider market interest in the asset.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.