- UTXO Realized Price Distribution shows DOGE accumulation at $0.10–$0.15 — suggesting minimal resistance ahead.

- Binance forecasts short-term upside to $0.317, aligning with bullish sentiment.

- $0.36 serves as both a technical and psychological resistance level, per behavioral finance studies.

Dogecoin (DOGE) is once again in the spotlight after on-chain analyst @ali_charts shared a Glassnode UTXO Realized Price Distribution (URPD) chart, highlighting bullish potential with a target of $0.36. The data reveals that a substantial volume of DOGE was last moved in the $0.10–$0.15 range — a sign that many holders are in profit and may not rush to sell, reducing overhead resistance if upward momentum builds.

The chart’s structure resembles previous bullish setups seen in Bitcoin’s past cycles, where low-volume resistance zones paved the way for quick rallies. Binance’s latest forecast predicts a 5% increase, placing DOGE at $0.3176 by week’s end — a short-term bullish confirmation in sync with the URPD signal.

Dogecoin’s historic volatility remains a factor. From its humble beginnings at $0.0004 in 2013 to its all-time high of $0.75 in 2021, DOGE has built a reputation as both a meme and a momentum asset. Behavioral finance research (e.g., Barberis et al., 2018) suggests that past resistance levels, like $0.36, often act as psychological anchors, influencing investor decisions even in the absence of strong technical factors.

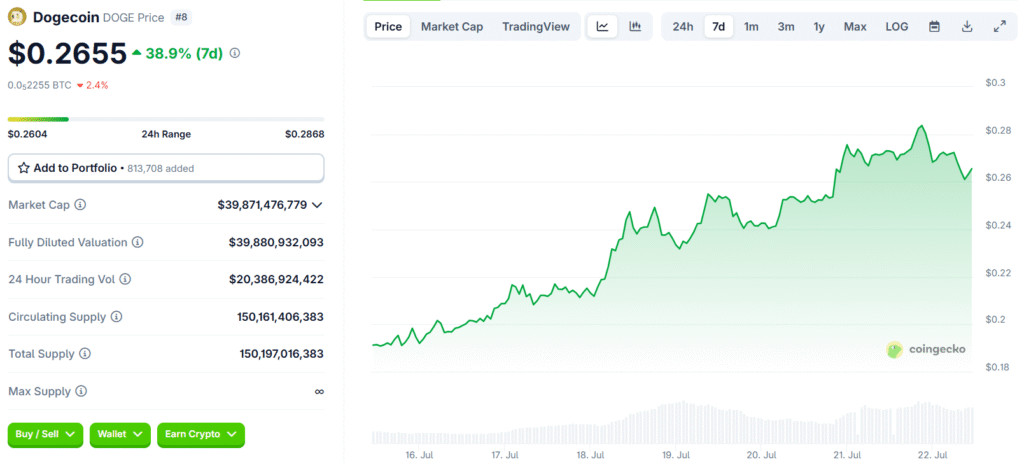

Community sentiment on X is split. Some, like @JKatz912, link this rally to growing utility and adoption, while others, such as @IMocara45967, remain cautious after repeated rejections near $0.287. Changelly’s short-term outlook is more conservative, predicting a 2.7% dip to $0.263 by July 23 — reflecting short-term volatility.

Ultimately, DOGE’s journey toward $0.36 hinges on sustained momentum, broader market sentiment, and retail enthusiasm. On-chain tools like Glassnode and social sentiment trackers remain key for navigating this high-risk, high-reward trade.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.