- A significant trader liquidation event occurred as Ethereum fell below $4,000, resulting in over $45 million in losses.

- With key technical indicators, like the 50-period moving average and MACD, showing continued bearish momentum, further downside is a real risk.

- Ethereum’s volatile price movement highlights the risks of high leverage in crypto trading, amplifying the impact of market downturns.

Ethereum (ETH) fell below the $4,000 mark, sparking a massive liquidation event. The cryptocurrency dropped by more than 3.5%, exacerbating fears of further price declines. A trader, identified as 0xa523, suffered significant losses after holding a leveraged long position in ETH.

Massive Liquidations Shake the Market

The collapse of 0xa523’s position marked a crucial point for Ethereum’s price action. Holding 9,152 ETH, the trader’s position was worth approximately $36.4 million. Once ETH dropped below $4,000, liquidation orders kicked in, closing the trader’s position entirely. This led to a loss exceeding $45 million, reducing their account balance to under $500,000.

Large sell orders added to the downward pressure, with positions being closed at $3,877.9 and $3,919.9. The In addition to increasing market uncertainty, the sale of more than 7,000 ETH at that price served to drive down the prices. The volatility and liquidation cascade of Ethereum displayed the risks associated with taking on too much leverage in volatile markets.

Technical Indicators Bearish Momentum.

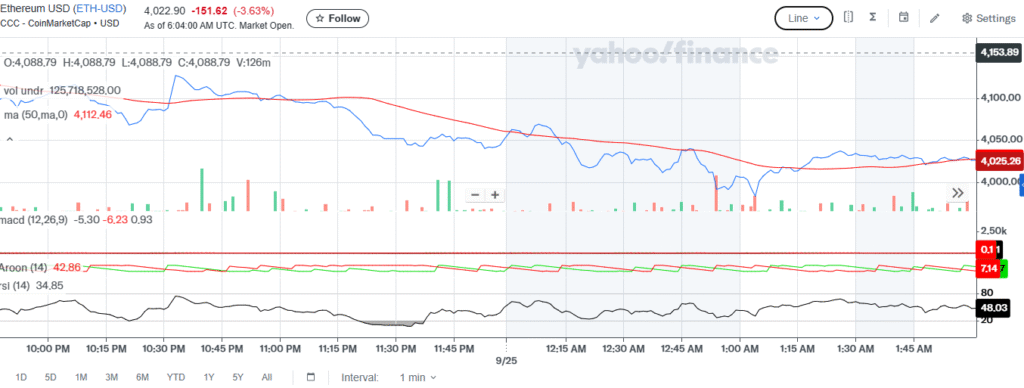

The Ethereum shows bearish momentum also in the technical indicators. The 50-period moving average (MA) of 4 112.46 is above the current price indicating that there is a short-term downward trend. The moving average cross also reveals ETH has performed below the mean value of the price in the recent past.

Source: Yahoofinance

The negative picture is supported by some other indicators like the MACD and the Aroon. The bearish momentum indicated by the MACD value of -5.30 and the upward value of the Aroon Down of 71.7 compared to the downward value of the Aroon Up, indicates the upward pressure. The RSI of 34.85 is already in the oversold zone, which is an indicator of a possible short-term recovery, however, more damage can still be done.

The current issues faced by Ethereum demonstrate that crypto markets are quite risky, particularly to traders with high leverage. Since ETH is trying to find its niche again, there is the possibility of a further price fluctuation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.