Ethereum fell over 6% in 24 hours and 27% in 30 days after breakdown.

• Bear flag structure sets measured downside target near $2,140 level.

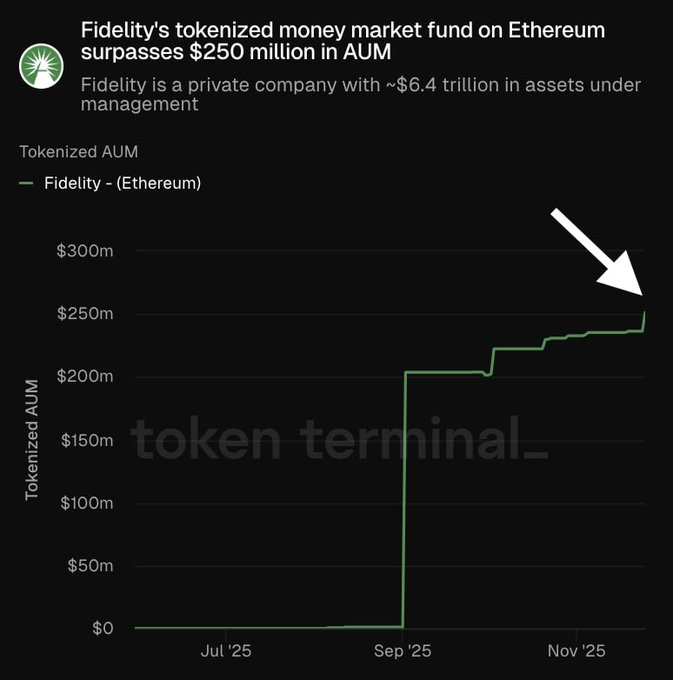

• Fidelity’s tokenized fund on Ethereum exceeds $250M showing RWA demand.

Ethereum has fallen over 6% in the past 24 hours and is now trading near $2,839. The asset slipped below the $3,000 level, marking a notable shift in short-term momentum. With a 27% decline over the last 30 days, Ethereum continues to face sustained selling pressure.

Ethereum Price Breaks Lower as Technical Setup Weakens

Ethereum price has fallen sharply, dropping more than 6% in the last 24 hours. The cryptocurrency is now down 27% over the last month.

This decline followed a failure to hold above the $2,990 resistance level. ETH had been trading in a short-term rising channel but broke below it, forming a classic bear flag pattern.

This pattern started after a 28.39% drop that formed the “pole” of the flag. The breakdown from the flag has set a measured target near $2,140.

TD Sequential Sell Signal and Trading Behavior

According to crypto analyst Ali, a TD Sequential sell signal was detected on Ethereum’s 1-hour perpetual futures chart on Binance. This trend-based indicator appeared shortly after ETH rose from $2,700 to above $3,100.

Historically, this signal has suggested short-term price weakness following rapid gains. Traders have also been watching price behavior near the $3,000 mark.

Meanwhile, Ethereum struggled to hold above this level, showing reduced momentum and bearish technical pressure.

Ethereum Layer 2 Growth and Tokenized Assets

Despite price weakness, Ethereum’s network usage is expanding. The DeFi Investor data from Growthepie shows that the number of active Layer 2 networks has reached 100.

These Layer 2s now process 84.60% of all Ethereum transactions. Transaction throughput has also increased, with Layer 2s reaching 328.57 transactions per second.

Meanwhile, institutional adoption continues. Fidelity’s tokenized money market fund on Ethereum now has over $250 million in assets under management.

The fund started to grow rapidly from September 2025 and reflects the growing interest in real-world asset tokenization on the blockchain.

Ethereum’s technical weakness has not slowed broader network adoption. However, traders remain focused on whether ETH can hold above key support zones in the short term.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.