- ETH drops below $3,700, triggering heavy risk for whale trader.

- AguilaTrades holds $116.9M ETH long near critical support level.

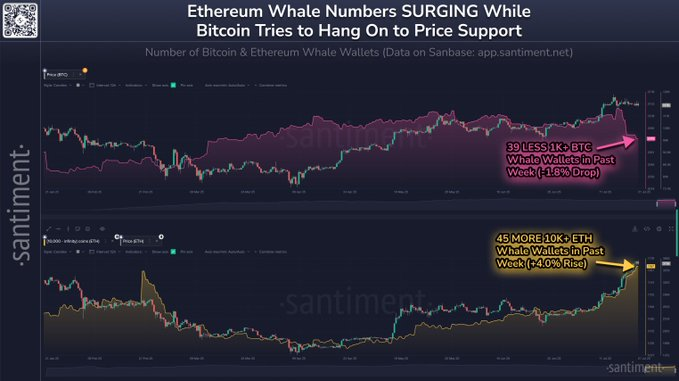

- Ethereum whales increase, while Bitcoin large holders decline significantly.

Ethereum’s recent price movements have triggered steep consequences for high-stakes traders. Hyperliquid data show AguilaTrades recently closed over $8 million in short losses in Ethereum before flipping to a long position. The trade initially turned a $35 million drawdown into a $3 million profit.

However, Ethereum’s price reversal quickly erased those gains. Current market data shows a long exposure valued at $116.9 million, backed by $7.69 million in equity. The liquidation level stands at $3,654.77, now only a few points above the trading price.

ETH has dropped below $3,700 and is testing a support level at $3,647.99. This proximity has raised concerns over forced liquidation.

Market watchers have highlighted that a breakdown below this support could send ETH down to $3,507.83 or even $3,313.19. AguilaTrades’ position now faces extreme downside risk, underlining the danger of large directional trades in volatile conditions.

ETH Breaks Below $3,700 As Support Gets Tested

Ethereum recently faced rejection near the $3,800 resistance zone. After reaching a high near $3,720, ETH failed to hold gains and retreated. The asset now trades at $3,649.53, hovering just above critical support. Market sentiment has tilted slightly bearish in the short term, although the broader trend remains upward.

Analysts point out that a sustained break below $3,647.99 could shift price action firmly toward bearish territory. On the upside, if ETH rebounds and maintains levels above support, a retest of $3,800 is possible.

A further breakout may push the price toward the next resistance near $3,973.75. Current technical patterns suggest the market is at a pivotal level, with whale trading behavior likely to shape near-term direction.

Ethereum Whale Accumulation Rises Sharply

Despite short-term weakness, whale activity has picked up on-chain. Over the past week, the number of Ethereum wallets holding over 10,000 ETH increased by 45, marking a 4.0% rise. In contrast, Bitcoin wallets holding over 1,000 BTC declined by 39, or 1.8%, based on the latest wallet distribution data.

Ethereum has climbed roughly 25% during this period, while Bitcoin dropped around 3%. This shift signals rising interest in Ethereum among large holders.

Analysts suggest whales may be positioning early for upcoming market drivers that favor ETH. The divergence in whale accumulation between Ethereum and Bitcoin further reflects this trend.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.