- Ethereum’s Q1 2025 dropped over 6%, marking historic lows.

- Legal victory with Tornado Cash could boost Ethereum’s prospects.

Ethereum (ETH) has had one of its worst first quarters in 2025. The cryptocurrency’s performance has dropped more than 6% in March alone, following a rough January and February. These losses have raised concerns about Ethereum’s potential recovery in the second quarter. Despite these challenges, there are signs that Ethereum might rebound in Q2. This article examines Ethereum’s Q1 struggles, recent legal victories, and whether it can regain momentum.

Key Factors Behind Ethereum’s Q1 Struggles

A sharp decline in value has marked Ethereum’s performance in Q1 2025. Data from CryptoRank shows that Ethereum’s return for January was down by 1.28%, followed by a 32.2% drop in February. By March, Ethereum had fallen another 6.27%. These losses have led to one of the most challenging starts to the year in Ethereum’s history.

Several factors have contributed to these struggles. Persistent selling pressure, lower network activity, and a significant decrease in active addresses weighed on Ethereum’s performance. Another key issue is Ethereum’s token burn rate, which has reached historic lows. On March 23, only 50.03 ETH, valued at less than $100,000, were burned. This suggests a slowdown in transaction volumes, signaling weaker market engagement.

A Legal Win and Potential for Recovery in Q2

Despite the difficult start to the year, Ethereum has seen positive development. The U.S. Treasury recently removed Tornado Cash from its sanctions list following the U.S. Court of Appeals ruling. The court found that sanctioning Tornado Cash’s immutable smart contracts was illegal. This legal victory has been hailed as a win for privacy advocates and decentralized technologies, with the Ethereum community celebrating the decision.

Ethereum heads into Q2, it must regain momentum by reaching key price levels. If ETH can break through the $2,100 mark, it may be on track for a recovery. Another positive sign is the reduction in Ethereum’s available supply on exchanges. According to Santiment, less than 9 million ETH are on trading platforms, the lowest level in nearly a decade. This suggests that more holders opting to stake their tokens or move them off exchanges, reducing selling pressure.

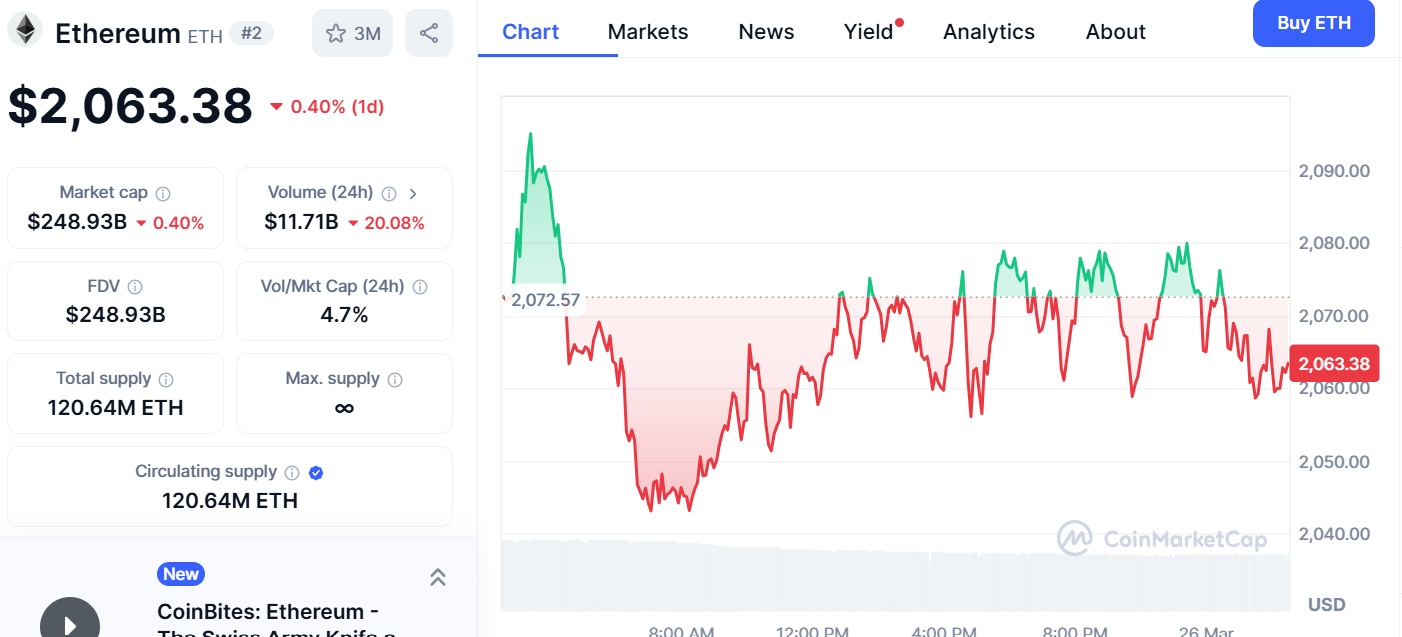

At press time, Ethereum’s price is $2,063.38, showing a 0.55% decrease over the last 24 hours.