- Ethereum MVRV data shows price stabilizing near $3,900, a key rebound level.

- Past MVRV rebounds led Ethereum toward $5,000 after each mean band retest.

- Traders eye $3,700 as the critical bounce zone in the current ETH correction.

Ethereum’s price has been consolidating near the $3,700 support level, a zone analysts expect to serve as a short-term bounce area. According to market analyst Crypto Tony, Ethereum could see a rebound from this region in the coming days or weeks.

However, if buying strength remains weak, the price could slide further toward $3,400–$3,300, indicating a potential short-term decline before recovery.

Technical charts show Ethereum trading between $3,700 and $3,900, suggesting that the market is waiting for stronger momentum. This consolidation has formed after a period of volatility in the broader cryptocurrency market, where major digital assets experienced notable pullbacks.

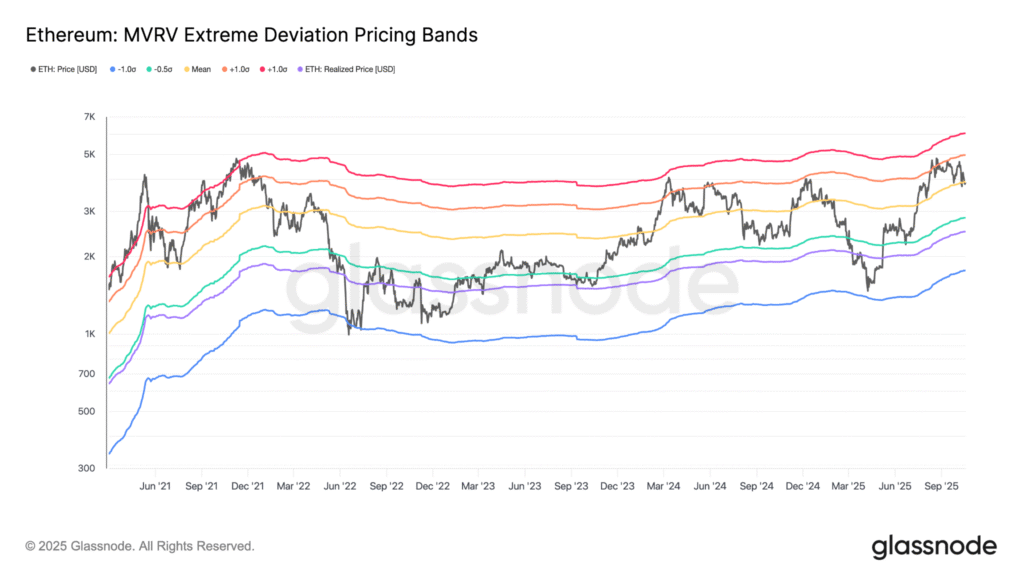

MVRV Data Points to $4,500–$5,000 Range

Meanwhile, Glassnode data MVRV Extreme Deviation Pricing Bands indicate Ethereum’s pullback has stabilized near the mean band around $3,900. Historically, this region has acted as a launch point for renewed bullish momentum.

Each time Ethereum has touched this midpoint including early 2021, mid-2023, and early 2024 the price later advanced toward the +1σ band, which currently aligns near $5,000. This structure signals that Ethereum may still be in a healthy correction phase within its broader market cycle.

Glassnode’s model further suggests that Ethereum could revisit the $4,500–$5,000 range if this pattern holds. Such movements have previously preceded strong recovery phases, particularly when investor sentiment gradually improves.

Institutional Accumulation and Broader Market Context

BitMine has accumulated $1.5 billion worth of Ether since the recent market correction, despite ongoing discussions about liquidity pressures and treasury concerns raised by market analysts such as Lee.

This accumulation trend supports the view that long-term investors remain confident in Ethereum’s structural growth. While short-term volatility persists, on-chain and institutional data continue to indicate that Ethereum’s long-term framework remains active within its ongoing bull cycle.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.