- Ethereum whales added $17 billion in ETH, signaling increased market demand.

- Ethereum exchange supply drops to a yearly low, signaling tightening conditions.

- ETH price remains stagnant, awaiting breakout above $4,700 resistance level.

Ethereum’s price has remained relatively stagnant, with key support and resistance levels shaping the market sentiment. As of today, ETH trades near $4,350, hovering between critical levels of support at $4,211 and resistance at $4,700.

While the cryptocurrency has displayed a corrective structure, oscillating in a narrow range, many traders are closely watching for a decisive breakout. A push above resistance could see ETH rally toward the $4,800 region. However, failure to break this resistance may lead to prolonged sideways movement, keeping traders on edge.

Whales Drive Market Sentiment as ETH Supply Tightens

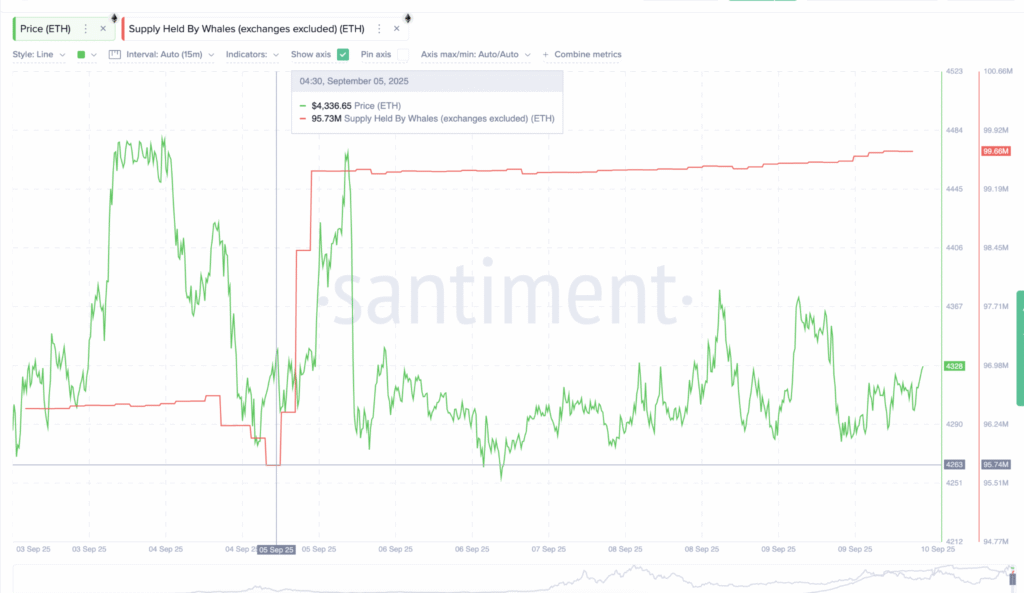

Over the past week, Ethereum whales have significantly increased their holdings. Santiment data shows that nearly 4 million ETH were scooped up by large wallets, totaling approximately $17 billion at current prices.

The accumulation took place between September 5 and September 10, during a period of consolidation. With exchange supply shrinking currently at its lowest level in a year, this trend signals tightening market conditions.

As fewer ETH coins are available on exchanges, the potential for upward price movement increases, especially with whales positioning themselves early in the market cycle.

“Whales often play a significant role in setting market trends,” said one crypto analyst. “Their moves can be early signals of larger price movements, especially when combined with tight supply conditions.”

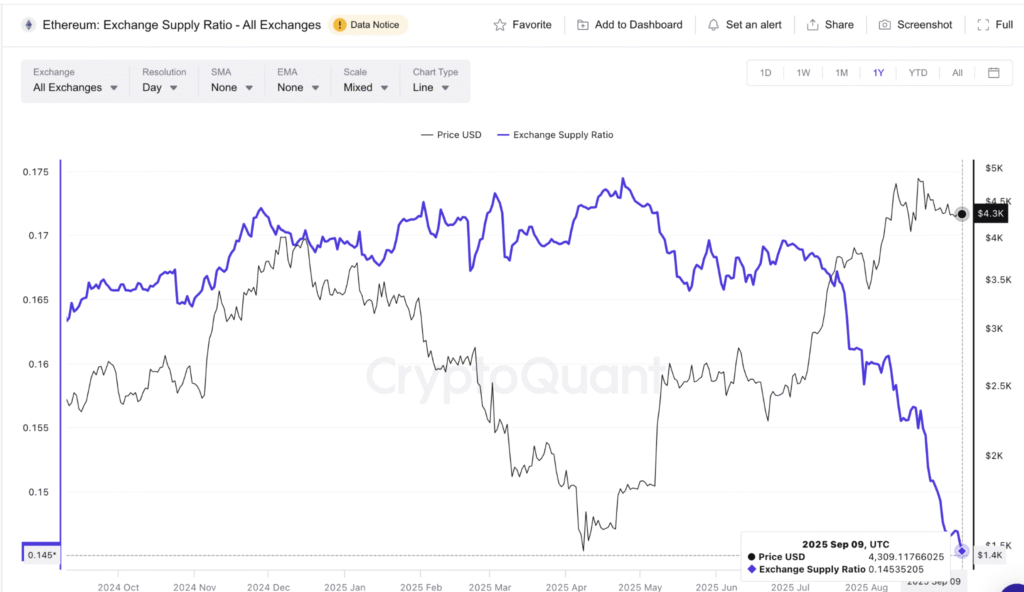

Ethereum Faces Potential Supply Squeeze

Ethereum’s exchange supply ratio, a measure of ETH held on exchanges versus the total supply, has dropped to 0.145. This is the lowest it has been in a year, showing that less Ethereum is available for trading.

CryptoQuant shows that the exchange supply ratio was 0.156 just weeks ago, in late August. As fewer ETH coins remain on exchanges, the available supply to market participants diminishes. This limited supply, coupled with increased whale accumulation, creates an environment conducive to a price breakout.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.