- ETHFI bounces off key support, positioning itself for potential growth.

- ETHFI’s FDV recovery shows strength, with market fundamentals driving price.

- ETHFI eyes significant upside, with a price target of $1.5 to $2 by year-end.

Ether.fi (ETHFI) has been showing potential for a bullish trend, as it maintains a steady bounce off a key support zone. Recent charts from World of Charts have indicated that if the token holds above this critical level, it could pave the way for upward momentum.

Traders are watching the key support level closely, as it has proven effective in stabilizing ETHFI during market fluctuations. With this level holding, ETHFI is poised for a price increase, possibly reaching between $1.5 and $2 per token by the end of October or November.

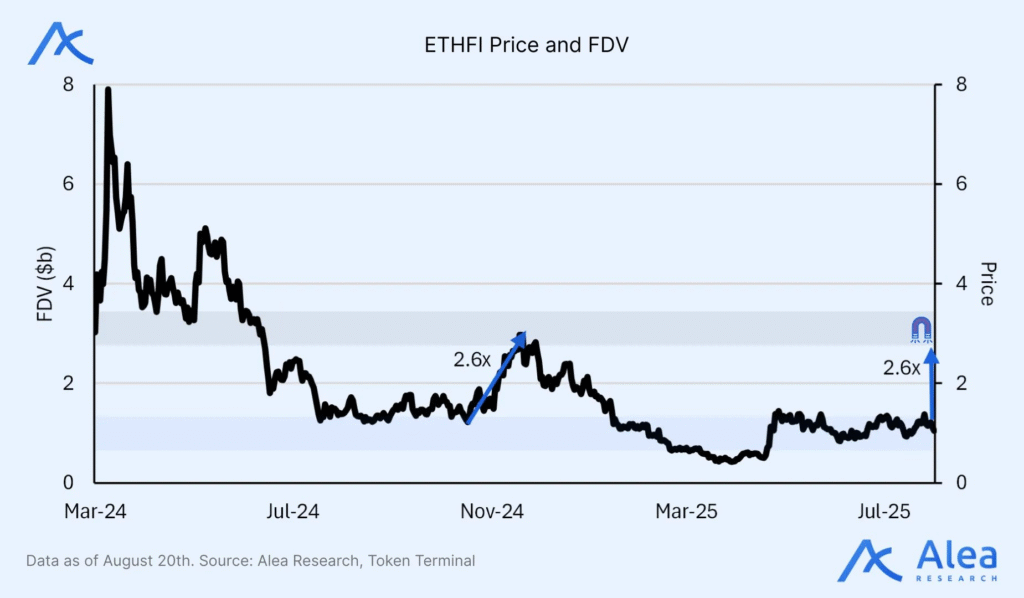

Recovery in ETHFI’s Price and Fully Diluted Valuation

Alea Research recently pointed to a notable recovery in ETHFI’s price and Fully Diluted Valuation (FDV). The report highlights that ETHFI’s FDV had dropped sharply by 90% earlier in 2024. However, data suggests a strong rebound, with FDV climbing 2.6x in 2024 and potentially growing by 4.1x in 2025.

This recovery is seen as a reflection of ETHFI’s growing market fundamentals, including increasing revenue and token buybacks. The price performance correlates closely with these fundamentals, pointing to a strong foundation for future growth.

Outlook for ETHFI in the Coming Months

As the market approaches the final quarter of 2025, ETHFI’s outlook looks optimistic. The support zone remains a critical level for traders, as it offers a solid foundation for price growth.

If ETHFI continues to hold above this zone, it is expected to trend upwards, with some projections suggesting a possible price range of $1.5 to $2 by November.

The combination of technical indicators and fundamental analysis paints a picture of a token that is recovering from its lows and positioning itself for a positive trend. ETHFI’s resilience in the face of market volatility and its strong recovery in FDV suggest that the token’s market performance could continue to improve as the year progresses.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.