- XRP’s $2.86 level remains a critical accumulation point, aligning with moving average support and prior pivots.

- Holding above the $3 psychological mark signals strength, with consolidation hinting at possible breakout potential.

- XRP shows 411% yearly growth and 50,999% all-time gains, confirming its resilience despite short-term pullbacks.

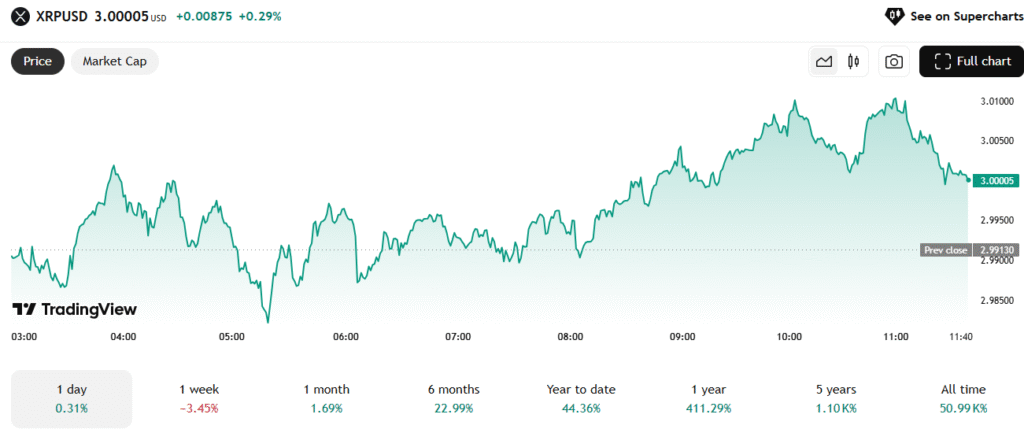

This week XRP remained stable around the $3 mark, which is characterised by a lack of movement through pullbacks in the short run. The coin ended at 3.00005 and had an insignificant day-to-day profit of 0.29. Although volatility continued during the day, XRP showed strength above the last close point of two ninety nine one dollars.

The $2.86 level emerged as an important support, acting as an accumulation zone for disciplined entries. This figure aligns with a previous pivot and moving average support. Waiting for retracement around this price helps manage downside exposure.

Recent trading activity showed consolidation and rejection near higher levels, which often signals potential pullbacks. However, support zones reinforce the outlook for renewed strength. Accumulation near historically reactive areas positions the market for possible breakouts.

Holding above $3 strengthens the bullish case while confirming that the asset remains in a consolidation phase. Momentum above this psychological threshold could encourage fresh rallies. A breakdown below the level might invite corrective pressures.

Performance Across Timeframes

Over one week, XRP recorded a decline of 3.45%, highlighting profit-taking after earlier gains. Over one month, the coin rose 1.69%, showing modest progress. Over six months, the asset advanced 22.99%, highlighting consistent growth.

Source: Tradingview

Comparing the annual growth, XRP was 411.29, which indicates a strong upward trend in the wider cycle. The performance, so far, has been 44.36 which further adds evidence of long-term resilience. In more than five years, the coin has realized profits, more than 1,100.

All-time figures remained extraordinary, with XRP up over 50,999% since inception. This long-term record underscored its relevance within the cryptocurrency sector. Despite regulatory pressures, the asset retained a strong role in shaping market direction.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.