- HBAR/ETH ratio declines to 0.000525, signaling a continued downturn.

- HBAR faces moderate bubble risk despite growing institutional interest.

- Hedera gains traction in RWA tokenization and ETF developments ahead of SEC approval.

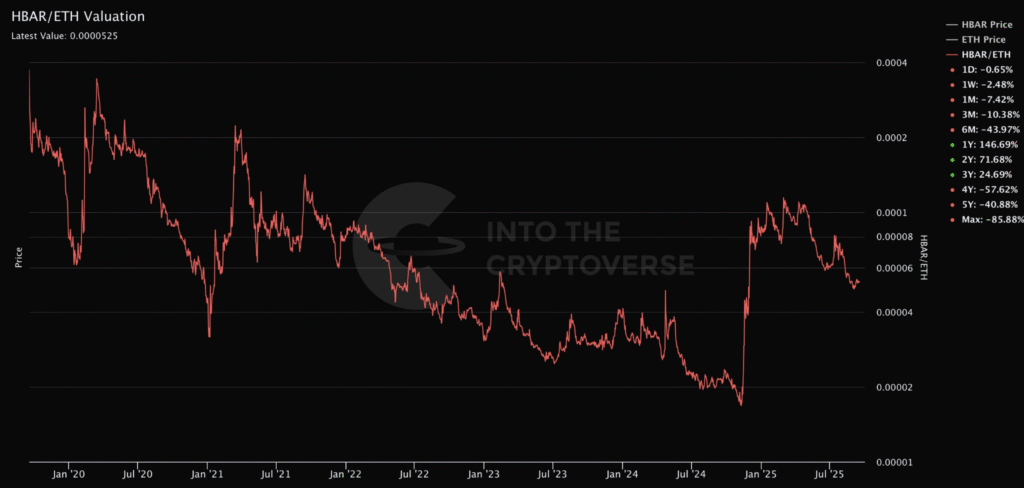

Hedera Hashgraph’s valuation, in comparison to Ethereum’s, has seen substantial fluctuations over time. From January 2020 to September 2025, the HBAR/ETH pair has gone through periods of both sharp declines and periods of stabilization. Mid-2021 marked a peak for HBAR, but it has faced a consistent downtrend since then.

Meanwhile, the HBAR/ETH ratio stands at 0.000525, indicating a continuing decrease in Hedera’s value relative to Ethereum. This trend aligns with broader market conditions, suggesting a struggle for Hedera in maintaining its competitive position.

Recent data points for the 1M, 3M, and 6M periods show further declines in HBAR’s performance compared to ETH. These sustained decreases point to the challenges Hedera faces in gaining sustained market traction.

Short-Term Bubble Risk Remains Moderate

The chart tracking Hedera’s valuation also includes an “HBAR Short Term Bubble Risk” index, which indicates fluctuations in HBAR’s market risk. These risk levels range from low (blue) to high (red) and have been notably elevated during periods of speculative behavior.

Significant spikes were seen around the price movements of mid-2021 and early 2025, suggesting that HBAR experienced overvaluation during these times. Currently, the bubble risk level stands at 1.12, reflecting a moderate risk environment for investors.

Hedera’s Growing Institutional Momentum

Hedera’s momentum has been gaining attention due to its developments in exchange-traded funds (ETFs), institutional adoption, and Real World Asset (RWA) tokenization. The U.S. Securities and Exchange Commission (SEC) is expected to approve the Canary Capital ETF by November 15, 2025.

This approval could mark a pivotal moment for Hedera, with analysts speculating that it could unlock billions in liquidity for the network and significantly boost the adoption of its native token, HBAR.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.