The cryptocurrency world is buzzing as @CryptoBusy’s recent X post spotlights a bullish forecast for Hyperliquid’s $HYPE token, accompanied by a chart signaling significant growth potential.

This comes on the heels of Hyperliquid’s remarkable rise, a decentralized exchange (DEX) that has captured 65% of the perpetual DEX market with a staggering $50 billion in daily trading volume. Launched in 2023 by Harvard alumni Jeff Yan and Iliensinc, the platform’s success is rooted in its innovative HyperBFT blockchain, processing 200,000 orders per second, rivaling traditional stock exchanges.

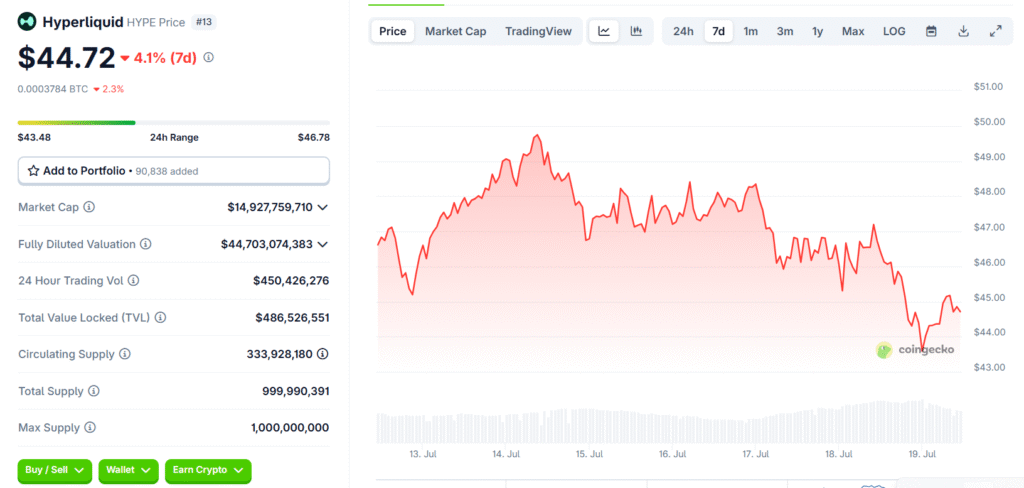

The chart shared by @CryptoBusy highlights $HYPE’s potential trajectory, despite a 4.1% dip from its $44.72 peak (per CoinGecko data).

This optimism aligns with Hyperliquid’s unique on-chain Central Limit Order Book (CLOB), a departure from typical Automated Market Maker (AMM) models, ensuring transparency and minimal slippage with 0.3% spreads refreshed every three seconds. The platform’s $340 million revenue since December 2024 further fuels this momentum, bolstered by a groundbreaking airdrop of 310 million $HYPE tokens, averaging $10,000 per user, which propelled the token from $3.90 to $44.

However, the journey hasn’t been flawless. The 2025 JELLYJELLY exploit, where a whale manipulated a $6 million short position into a $12 million loss, tested Hyperliquid’s resilience. The team’s swift delisting and profit recovery of $700,000 showcased crisis management, yet sparked debates over its decentralization, with critics like Bitget’s CEO Gracy Chen questioning its integrity. Arthur Hayes of BitMEX also weighed in, suggesting the platform’s centralized responses blur its DeFi ethos.

For investors, the “DYOR” call is critical. Hyperliquid’s community-driven Hyperliquidity Provider (HLP) vault and no-VC funding model underscore its grassroots appeal, but risks remain amid a competitive landscape, with rivals like @VestExchange leveraging AI risk engines. As DeFi matures, Hyperliquid’s blend of CEX-level performance and DEX transparency positions it as a trailblazer—though its ability to maintain dominance hinges on addressing decentralization concerns. With the market up 5.60% weekly, $HYPE’s next move could redefine crypto trading standards.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.