- Liquidity is shifting within Mantle as $MNT’s rally drives renewed activity toward native decentralized applications, especially $MOE, the leading DEX token.

- Rising on-chain volume, higher total value locked, and growing participation from liquidity providers signal strengthening fundamentals across Mantle’s Layer 2 network.

- With a modest $17 million market cap, $MOE mirrors early-stage DEX tokens from other Layer 2 ecosystems that later reached valuations above $100 million.

Mantle Network is emerging as a growing hub for decentralized finance activity as its native token, $MNT, records a new all-time high. The Layer 2 protocol has seen increasing market confidence following visible support from the major exchange Bybit. As a result, market participants are redirecting liquidity toward Mantle’s expanding ecosystem, signaling renewed interest in its decentralized applications.

Momentum across Mantle’s ecosystem continues to build, supported by strong transaction activity and rising on-chain volumes. The network’s growth aligns with a broader rotation trend within Layer 2 ecosystems, where capital typically flows from main tokens to native applications. Consequently, decentralized exchanges and liquidity hubs within Mantle are seeing significant user participation and higher transaction throughput.

The ecosystem’s expansion indicates strengthening fundamentals as Layer 2 platforms attract both developers and liquidity providers. Mantle’s rising total value locked (TVL) and user engagement suggest sustained adoption momentum. Moreover, these developments position Mantle as a potential competitor among established networks like Optimism and Arbitrum.

$MNT Drives Ecosystem Confidence

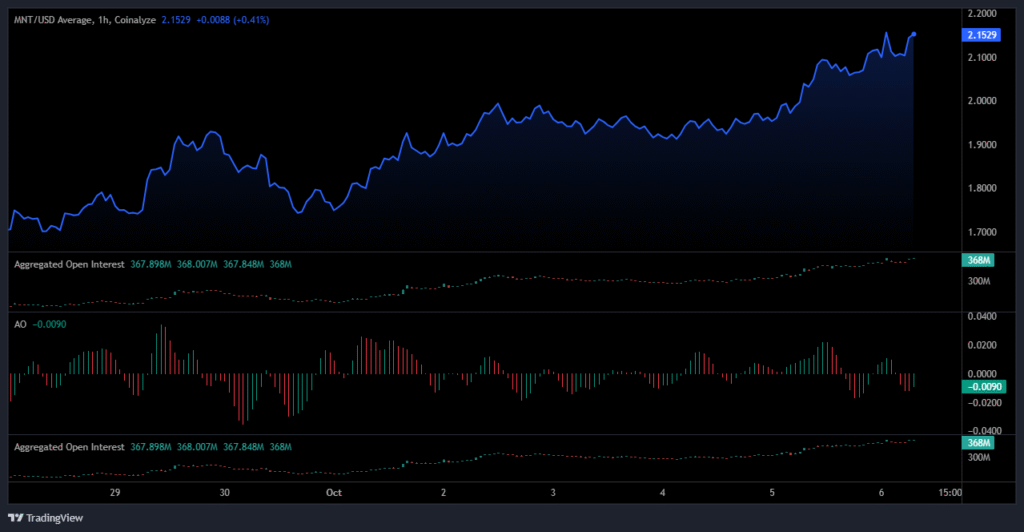

The price of $MNT recently reached $2.1, reflecting growing confidence in Mantle’s network efficiency and scalability. The milestone underscores strong demand for Layer 2 solutions that lower transaction costs while maintaining Ethereum-level security. As adoption widens, liquidity concentration around Mantle’s dApps continues to rise.

Source: Coinalyze

Furthermore, the upward price action supports optimism about the network’s long-term sustainability. Enhanced activity around governance and staking contributes to a more active user base. This strength reinforces the view that Mantle’s progress could drive new market opportunities across its DeFi ecosystem.

Additionally, the surge in $MNT demonstrates how robust Layer 2 performance can boost investor attention and cross-protocol liquidity. Sustained performance at current levels may further strengthen Mantle’s market position. Broader participation from exchanges and liquidity platforms continues to validate its ecosystem outlook.

$MOE Emerges as Mantle’s DeFi Contender

Within the ecosystem, $MOE has become the leading decentralized exchange token with strong on-chain performance. The token’s current market capitalization stands near $17 million, highlighting significant growth potential. Increasing volumes and active maker participation demonstrate expanding network engagement across Mantle’s liquidity pools.

Trading data shows consistent volume spikes, including transactions exceeding $6 million and $4 million, reflecting robust user demand. These metrics suggest an upward trend supported by strong community participation and efficient protocol design. As Mantle’s liquidity expands, $MOE’s position as a primary trading hub strengthens further.

Historical Layer 2 cycles show that native DEX tokens can achieve valuations between $100 million and $300 million during peak momentum. If Mantle’s adoption continues, $MOE may follow a similar trajectory. Sustained network growth, liquidity inflow, and ecosystem expansion could fuel a substantial market revaluation for the token.