- Michaël van de Poppe sees $6 as a strong buying opportunity.

- Chainlink $LINK may experience significant growth with upcoming bull market.

- Current support levels at $6 suggest a potential price breakout soon.

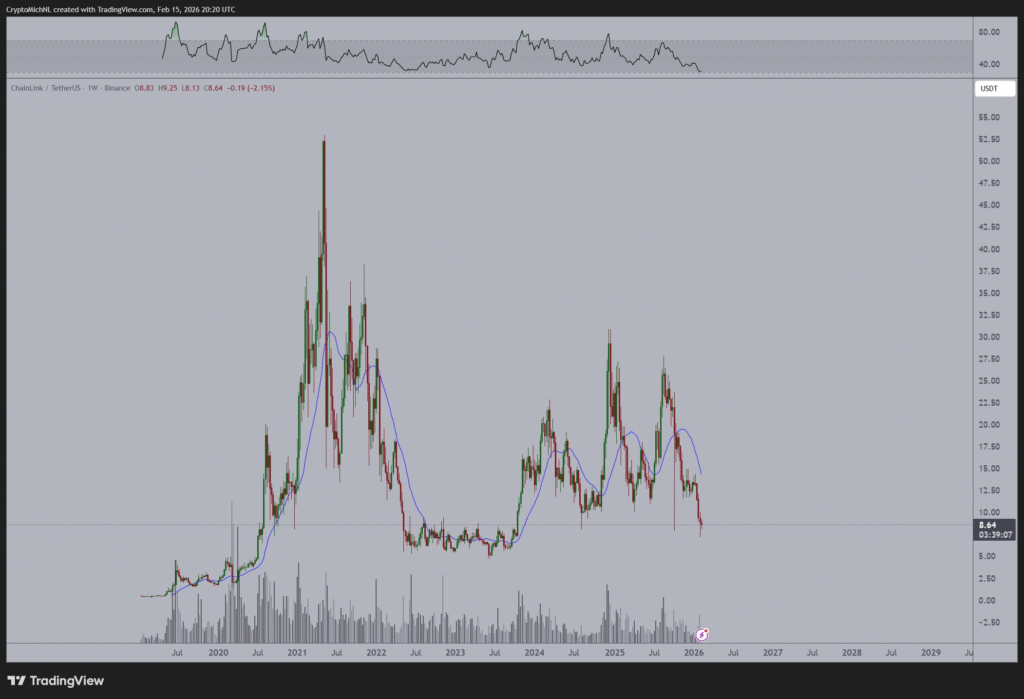

Chainlink (LINK) is drawing attention as crypto analyst Michaël van de Poppe highlights a major opportunity at $6. With a strong bull market on the horizon, van de Poppe believes $LINK could experience significant growth from its current price levels. Is $6 the perfect entry point for investors?

Michaël van de Poppe’s Bullish Call on $LINK at $6

Crypto analyst Michaël van de Poppe has reiterated his bullish stance on Chainlink ($LINK) with a target price around $6. Van de Poppe highlighted the current price levels as a significant opportunity for investors to scale into one of the most promising assets in the crypto ecosystem.

He shared his insights, pointing out that the broader crypto market is gearing up for a strong bull market, which could lead to substantial growth for Chainlink.

In a recent social media post, he mentioned, “I think that we’ll see a strong bull market on crypto from here.” The key level of $6, in his opinion, represents a critical entry point before a potential surge in Chainlink’s value. The price action shows that $LINK has recently been testing important support levels, which strengthens the case for a bullish breakout.

Chainlink’s Potential Price Growth as Bull Market Begins

Van de Poppe’s analysis is based on the technical setup, in which Chainlink is well positioned for a potential rally. His previous assessments have shown that $LINK has consistently been one of the best-performing assets in the crypto space.

By holding above key support levels, $LINK may see a similar surge to previous high growth periods, where the token rose sharply after key trendline breaks.

The market is currently positioning itself for a broader crypto rally, with Chainlink set to benefit from these overall positive conditions. $LINK has been following a well-established upward trajectory, and the recent price stabilization could signal further upside potential.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.