- OKB printed an ATH near $195 after a two-month vertical run; consolidation above $190 would refresh momentum for a $200 test.

- With ~21M supply circulating, shallow books magnify swings; losing $188 risks a gap-fill toward $185–$183.

- July–September address spikes looked episodic; sustained spot volume plus rising addresses would validate continuation.

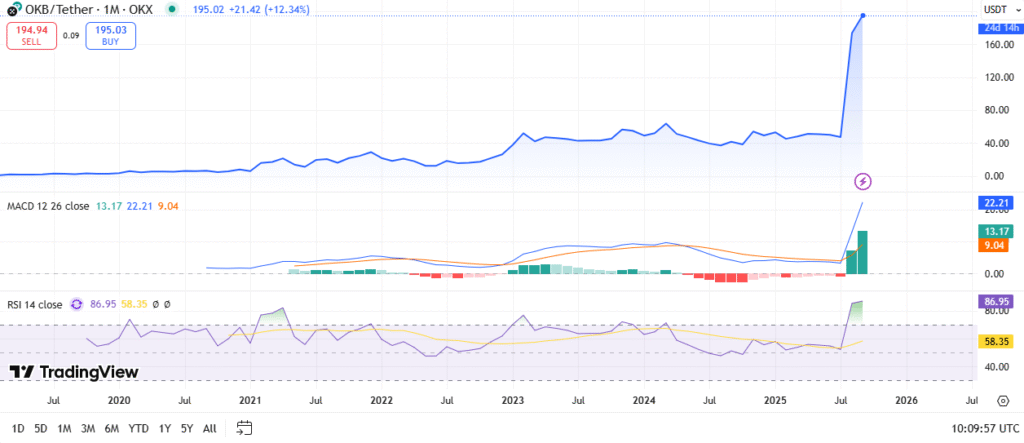

OKB accelerated into price discovery as the token jumped toward $195 and then paused near $190. The move followed a two-month vertical run that lifted price beyond the 2021–2024 range. Consequently, the tape now favors consolidation above new support while momentum remains elevated.

Vertical breakout and monthly momentum

OKB left the $70–$85 band and established a fresh all-time high around $195. That regime change turns the former ceiling into a structural support shelf. Therefore, pullbacks toward that zone carry higher probability of demand.

Source:Tradingview

Monthly momentum strengthened as MACD crossed up and the histogram expanded. RSI printed near 87, which signals an extended trend. In strong advances RSI can stay hot, yet such prints often precede volatile pauses.

Upside focus centers on the $200 psychological magnet, where a monthly close could extend gains. Nearest support sits at $170–$180, then $150–$160 as a deeper retrace area. The “must-hold” structure remains $95–$110 around the old range high.

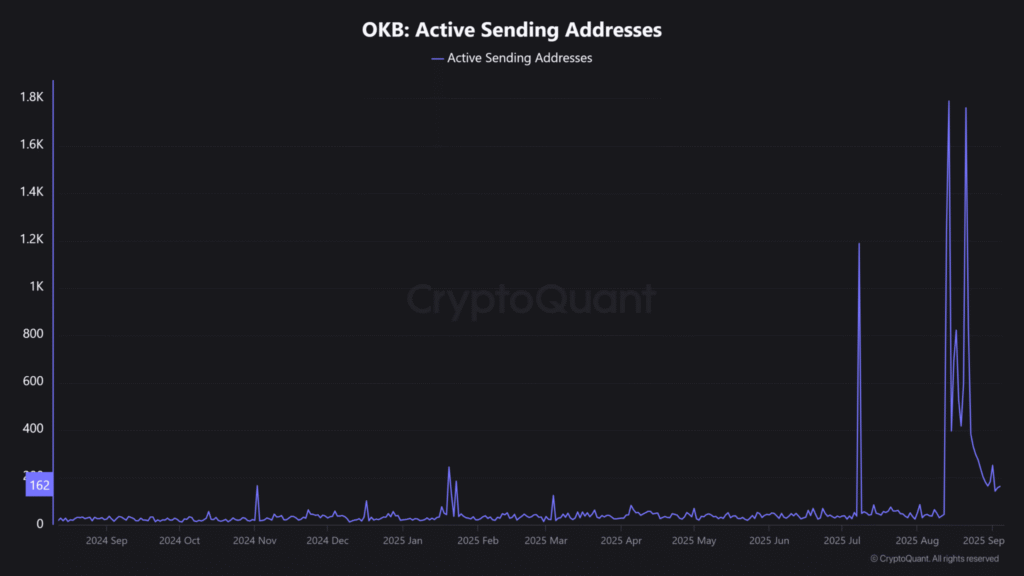

Address activity and flow signals

On-chain readings showed unusual bursts in active sending addresses during July and August. Counts spiked toward 1.2k and later near 1.7k–1.8k before retracing sharply. Activity then cooled back toward 150–250 in early September.

Source: Coinmarketcap

Exchange tokens often register modest on-chain traffic because turnover concentrates inside venue ledgers. Consequently, the spikes look episodic and likely tied to operational events or discrete campaigns. The quick retracement argues against a sustained user-base expansion.

Flows still matter for near-term risk. Rising addresses with positive spot volume and stable price typically imply organic demand. Conversely, rising addresses with soft price can warn that supply is returning to markets.

Intraday structure and trade scenarios

Intraday, OKB rallied from the mid-$180s to near $195 in a one-sided push. Because the distance to support widened, mean-reversion risk increased. A tight base above $190 would help reset stretched conditions.

Supply metrics show total and circulating supply around 21 million tokens. The tight float means order-book imbalances can move price quickly. Elevated volume helps sustain trends, yet fading participation can produce sharp pullbacks.

Source:CryptoQuant

Continuation requires holding $191–$192 and then posting an hourly close through $195–$197. That break could target the $200 handle and extend discovery. Consolidation between $188 and $195 would digest gains and build a higher base.

Reversal risk rises if price loses $188 on expanding volume. That failure would open a gap-fill toward $185–$183 where prior resistance turned support. Until structure loses the $185 area decisively, the bias stays upward but management remains essential.

Outlook

The breakout to $195 marks a clear shift into price discovery for OKB. Consolidation above $190 would strengthen the platform for another attempt at $200. However, a quick slip below $188 would warn the vertical leg is fading and invite a deeper test.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.