- Cumulative perp volume reached $9.08T on October 2, 2025, led by growing on-chain trading activity.

- Rising institutional demand and ETF interest have driven perpetual DEX growth since early 2024.

- Strong user growth and increased risk appetite boost trading across perpetual protocols.

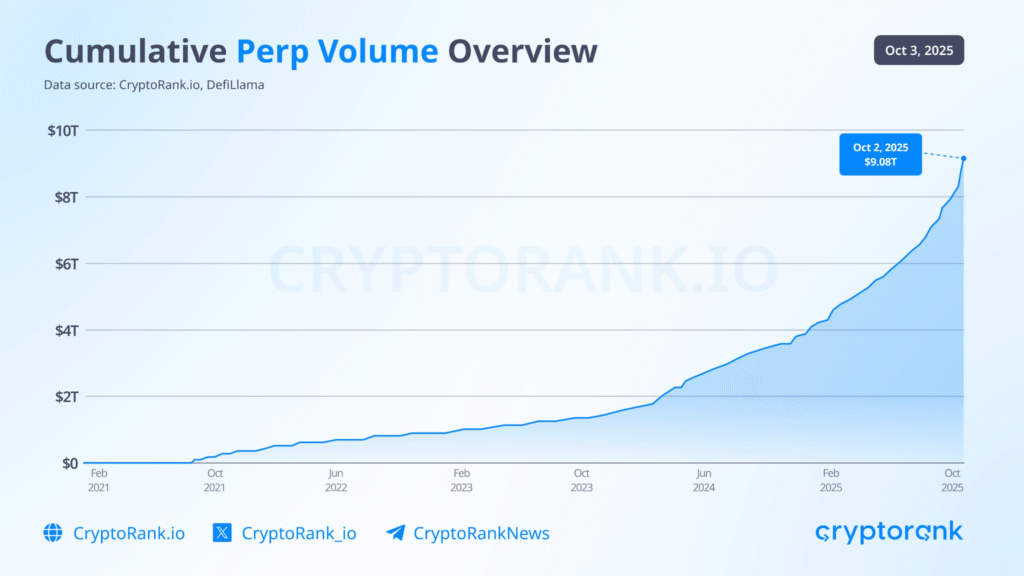

Perpetual trading volume across decentralized protocols has exceeded $9 trillion, according to data from CryptoRank.io and DeFiLlama. As of October 2, 2025, cumulative perp volume reached $9.08 trillion.

The rapid growth trend is linked to higher institutional activity, stronger user interest, and increased demand for crypto exposure. The chart shows a steep upward trajectory beginning in early 2024. The growth accelerated sharply in mid-2025.

This period saw increased competition among perpetual DEXs, improved product offerings, and better trading incentives. The influx of traders seeking yield and leveraged positions also contributed to the surge.

Institutional Activity and ETF Demand Drive Growth

The recent rise in volume is supported by rising institutional participation in the perpetual markets. Multiple platforms have reported an increase in volume from professional traders. The approval of several crypto ETFs in 2025 has also attracted attention toward on-chain derivatives. This has helped traditional investors gain exposure to crypto without holding the underlying assets.

Increased regulatory clarity has also played a role. Jurisdictions such as Hong Kong and the UAE have opened their markets to crypto-native institutions. With more capital flowing in, perpetual DEXs have expanded liquidity and execution depth, which attracts further activity. As a result, daily trading volumes have hit new highs across many platforms.

User Growth and Protocol Competition Fuel Volume

Crypto adoption among retail users continues to rise, driven by enhanced user interfaces and lower trading fees. The expansion of Layer 2 networks and rollups has made on-chain perpetual trading more accessible. This has helped decentralized platforms gain more share from centralized exchanges.

Competition between DEXs has led to the development of new trading models, including point systems and reward programs. These incentives have increased trader engagement and transaction frequency. Some protocols have also introduced cross-margin and multi-collateral features, attracting both new and experienced users.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.