- Chris Larsen earned $764M profit from XRP after Ripple’s SEC court win.

- He moved 50M XRP worth $120M tied to Evernorth’s $1B treasury plan.

- XRP trades near $2.41 as analysts see early signs of market recovery.

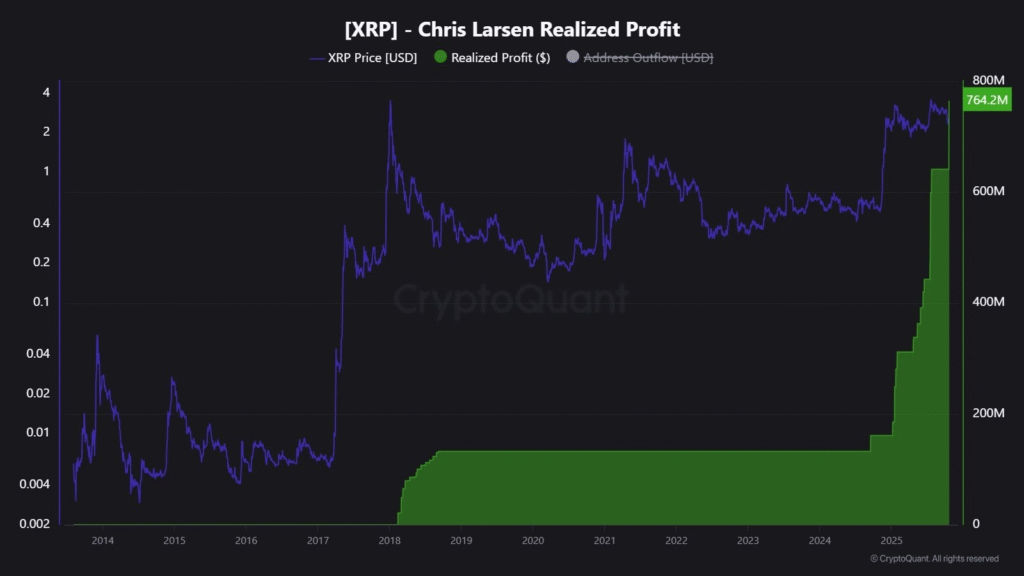

Ripple co-founder Chris Larsen has recently transferred 50 million XRP, valued at nearly $120 million, according to on-chain data. The move follows a period in which Larsen realized around $764 million in profit from XRP holdings, coinciding with Ripple’s legal victory over the U.S. Securities and Exchange Commission.

Larsen’s Realized Profit and Trading Pattern

Meanwhile, Data from CryptoQuant analyst Maartunn indicates that Larsen’s profit from XRP remained under $200 million until early 2025. It rose to $764 million after XRP prices rallied following Ripple’s favorable court decision.

Analysts have noted that Larsen’s previous transactions often occurred near market highs, reflecting a consistent pattern of profit-taking.

Blockchain activity reveals several wallet movements associated with Larsen that coincide with local price peaks. Earlier this week, he transferred 50 million XRP, triggering concerns about another possible large-scale sell-off.

However, Larsen clarified that the recent transaction was related to an investment commitment rather than a market exit.

Connection to Evernorth Treasury Initiative

Larsen confirmed that the latest XRP transfer was part of his investment in Evernorth, a Ripple-backed company developing a $1 billion XRP-focused treasury. He explained, “Evernorth fills the missing link today in XRP capital markets and XRP usage in DeFi products. I’m proud to invest 50 million XRP in the firm.”

Major institutions, including SBI, Pantera Capital, Kraken, and GSR back Evernorth Holdings. The company aims to strengthen XRP’s liquidity and promote its adoption in institutional markets. Larsen’s involvement signals continued support for Ripple’s broader ecosystem despite profit-taking from his holdings.

XRP Market Outlook

XRP is currently trading around $2.41, up 1 percent in the past 24 hours. The token remains 34 percent below its multi-year high of $3.66 recorded in July. Analysts note that XRP has faced a 16 percent monthly decline amid market consolidation and profit-taking.

Technical indicators show possible signs of stabilization. The Relative Strength Index suggests weakening bearish momentum, while a potential MACD crossover could indicate renewed buying strength.

XRP needs to reclaim the 200-day Simple Moving Average at $2.60 to confirm a short-term recovery. Historical trends suggest that November has often been a positive month for the token, with average gains of nearly 88 percent.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.