- SEI broke above $0.205 confirming a bullish structure on TradingView data.

- Analyst Ali sees $0.22 as the next target aligned with resistance.

- Crypto Patel projects a 49.81% potential rally toward the $0.30 level.

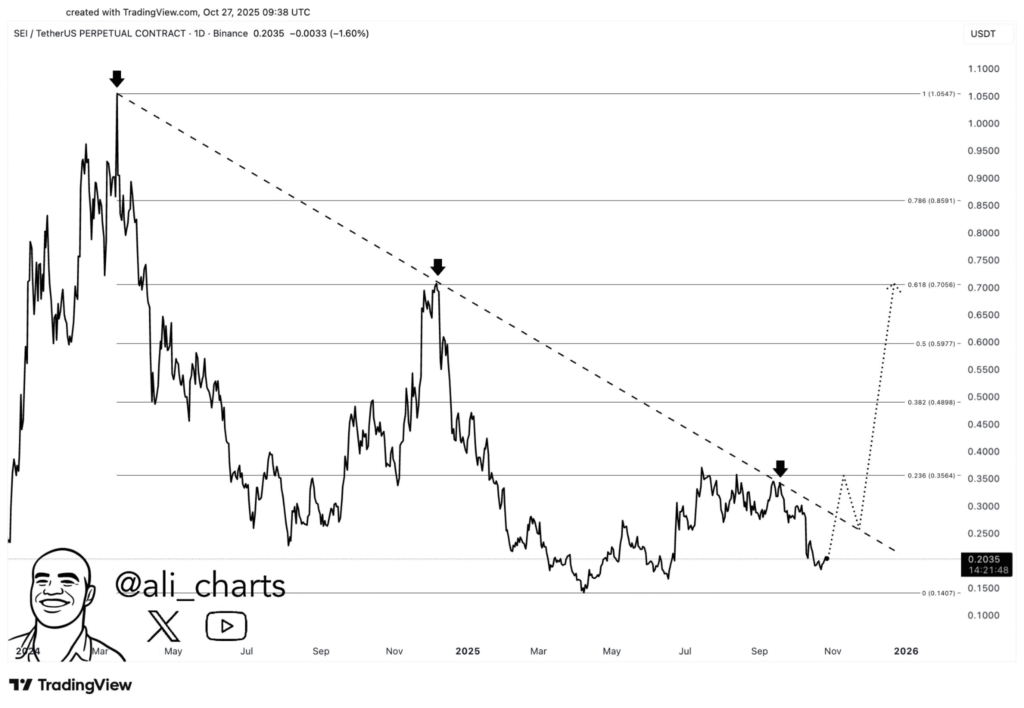

SEI has drawn renewed market attention after breaking out of a prolonged downtrend. The move above $0.205 has shifted short-term sentiment among traders. According to TradingView data SEI traded at $0.2050, slightly down by 0.63% in the last session.

Analyst Ali posted on X that SEI’s breakout followed weeks of consolidation within a falling wedge. The pattern had developed during a long bearish phase, which often signals a potential reversal.

Ali noted that the breakout near $0.20 reflected a change in control from sellers to buyers. He identified $0.22 as the next target, aligning with a Fibonacci retracement zone and resistance from mid-October.

Analysts Watch for Retest of Breakout Zone

Ali cautioned that short-term pullbacks could occur as SEI retests the breakout trendline. He stated that maintaining higher lows above $0.20–$0.203 would support a recovery phase. “If this level holds, the reversal setup remains valid,” he said.

Another analyst, Crypto Patel, echoed a bullish tone. He posted a chart showing SEI breaking above a descending trendline after several failed attempts. The chart suggested a potential rally of nearly 50%, with a target around $0.30 if momentum continues.

Patel described the structure as “short-term bullish,” noting that volume was increasing after the breakout.

Support and Market Context

Altcoin Sherpa added a cautious perspective, saying SEI is technically at support but lacks strong external drivers. His chart on Binance’s three-day timeframe shows SEI holding between $0.20 and $0.21, an area that has supported price multiple times this year.

Traders are now watching for confirmation above the $0.21 resistance zone. The $0.1908 area, which previously acted as resistance, is now serving as support.

As market activity builds, SEI’s ability to hold above key levels will determine whether this breakout leads to a sustained upward move.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.