- BitMEX delists SHIBUSD contract on September 11 due to low activity.

- Shiba Inu faces reduced exposure in derivatives market amid declining demand.

- Weak market momentum signals potential further struggles for Shiba Inu’s price.

Shiba Inu (SHIB) is facing an unexpected setback as BitMEX, a well-known crypto derivatives platform, announces it will delist the SHIBUSD perpetual contract. This move is set to take place on September 11, 2025, due to low trading interest.

The delisting indicates that Shiba Inu’s derivatives market is losing steam, as reflected by the shrinking liquidity and trading volume surrounding the asset.

The SHIB/USD pair will be removed from BitMEX, and all open orders for the perpetual contract will be canceled by the stated deadline. This decision follows a period of decreased activity and investor interest in SHIB’s derivatives.

BitMEX has cited insufficient demand as the reason for this removal, a decision that affects not just retail traders but also larger institutional participants who utilize these contracts for hedging and speculative purposes.

Shiba Inu’s Struggle in the Market

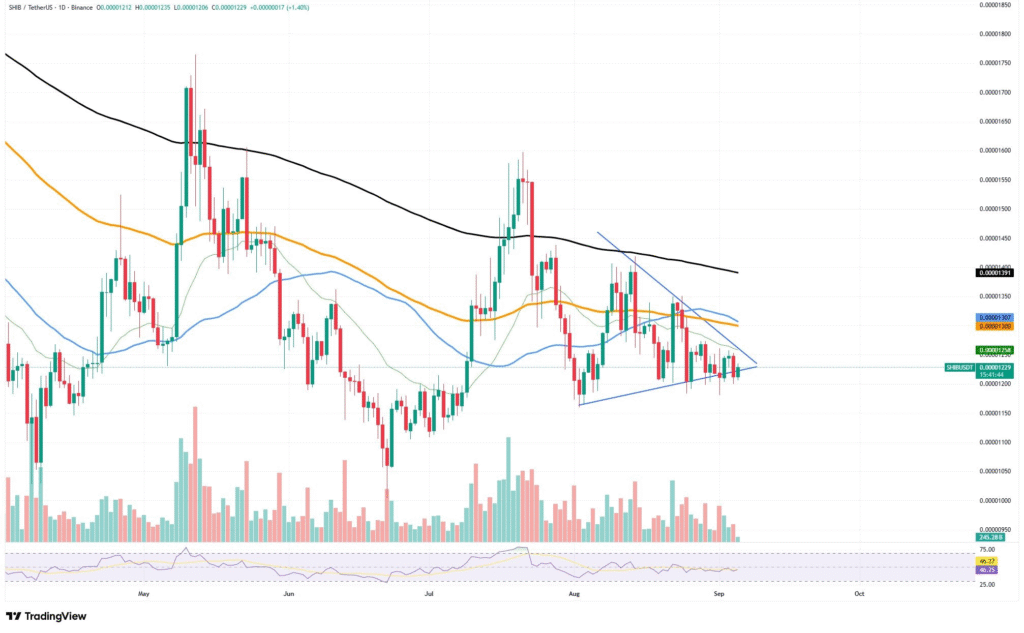

Shiba Inu has experienced a prolonged battle for dominance in the market, particularly within the $0.0000120 to $0.0000130 price range. This price consolidation reflects a struggle between bulls and bears, with neither side able to gain significant control.

The recent market action, however, shows a trend toward declining momentum, as indicated by the Relative Strength Index (RSI) sitting at 46, signaling weak market interest.

Along with the declining trading volumes, the Shiba Inu token faces resistance from several moving averages, including the 200-day EMA near $0.0000139. These factors are putting pressure on the asset’s price, creating challenges for any significant upward movement.

The Broader Consequences of the Delisting

Although BitMEX’s decision only affects Shiba Inu’s derivatives market and not its spot trading, it underscores the broader trend of diminishing market interest. The delisting is a clear sign that speculative demand for SHIB is waning, and this could lead to further concerns regarding the asset’s future stability.

The removal from a major platform such as BitMEX may also influence other exchanges to reconsider their exposure to Shiba Inu, putting additional pressure on the token.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.