- Solana generated $222 million in network fees in Q3 2025, surpassing other blockchains.

- Solana has captured 46% of all fees in the cryptocurrency ecosystem in the past year.

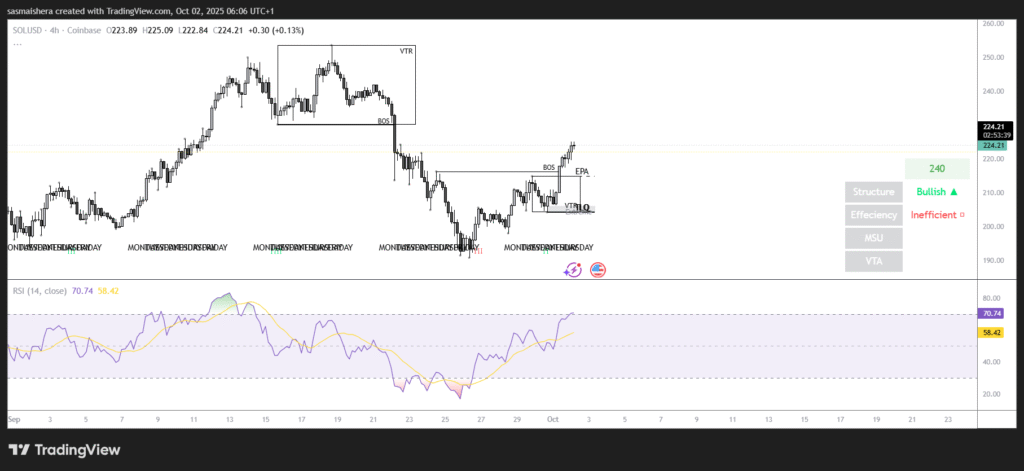

- SOL/USD is showing bullish momentum, with resistance levels set at $220 and $241.

Solana Continues to Lead Blockchain Revenue in Q3 2025

In the third quarter of 2025, Solana has maintained its lead in network revenue, further solidifying its position as one of the top performers in the blockchain ecosystem. The network generated a remarkable $222 million in fees for blockspace, marking its fourth consecutive quarter as the top performer.

However, performance has raised expectations for Solana’s future growth, especially considering the trends observed over the past year. The blockchain ecosystem as a whole has witnessed a considerable increase in total fees paid, and Solana’s dominant share of this growth is notable.

With $2.1 billion in fees collected over the past year, Solana has captured 46% of all fees across major cryptocurrency networks, outperforming competitors such as Ethereum and Bitcoin. This dominance in network fees reflects the growing trust and use of Solana in various decentralized applications (dApps) and blockchain-based services.

Solana’s Bullish Momentum and SOL/USD Forecast

A positive price movement for SOL, the native token of the Solana blockchain has accompanied Solana’s impressive fee revenue. The SOL/USD 4-hour chart has shifted to a bullish pattern following a recent surge in SOL’s price. After breaking above the $220 resistance level, the price of SOL is now trading at $224, showing potential for further price increases.

Momentum indicators, including the Relative Strength Index (RSI) and the Moving Average Convergence/Divergence (MACD), have shifted into bullish territory. The RSI currently stands at 70, indicating that buyers are in control; however, it also suggests that the market could soon enter overbought territory.

Should the momentum continue, SOL could target the next major resistance level at $241. However, the chart also indicates the possibility of a short-term pullback to the $214 mark before a more significant rally.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.