Solana ($SOL) finds itself at a pivotal moment, as highlighted by crypto analyst @crypto_rand in a recent X post.

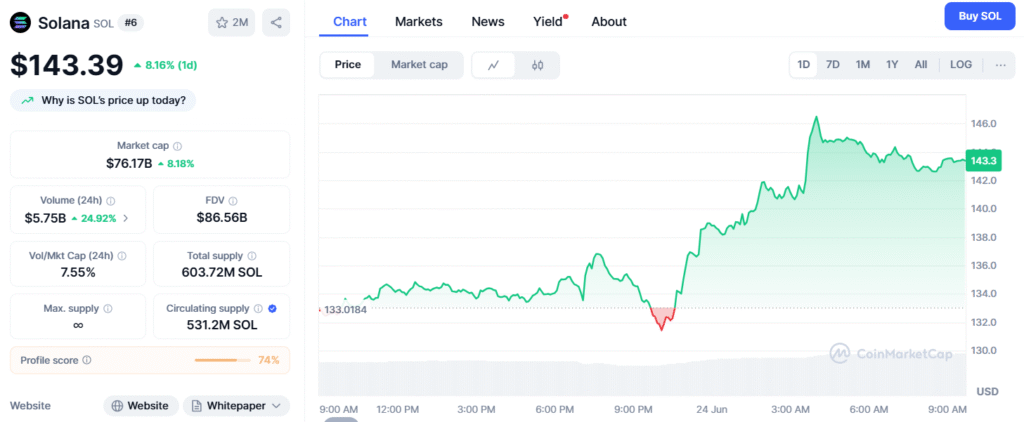

The accompanying chart reveals $SOL holding firm above the $125 support level, with a recent surge testing a key downtrend resistance—a scenario that could herald a significant price movement. Current market data, including a $1.3 billion surge in staking deposits reported by fxstreet.com, underscores robust investor confidence, potentially fueling a breakout toward $210 if resistance is breached. This aligns with a 25% weekly gain trend observed since November 2024, reflecting Solana’s resilience amid broader market volatility.

The analyst’s reference to a “final squeeze” suggests a technical setup where short sellers may be forced to cover, amplifying upward momentum. This is particularly timely, given the seasonal optimism surrounding the summer solstice, historically a period of heightened speculative activity in cryptocurrencies. TradingView analyses further support this, noting $SOL’s movement within a downward channel, where the upper trend line acts as strong dynamic resistance. A successful breakout above this level, potentially near $168.32, could confirm a bullish continuation, while a rejection might see prices retest support.

On-chain metrics and community sentiment, as seen in replies from users like @vaneck_us and @RyanAdams73118, reinforce this bullish outlook, with some predicting $SOL could reach $500 if momentum sustains. However, caution is warranted—volatility remains high, with a recent 4.68% daily drop noted in web data. Traders should monitor volume surges and key Fibonacci levels for confirmation.

For now, $SOL stands at a crossroads, with the next few days critical in determining whether it breaks out or faces another downturn. Stay tuned for real-time updates as this story unfolds.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.