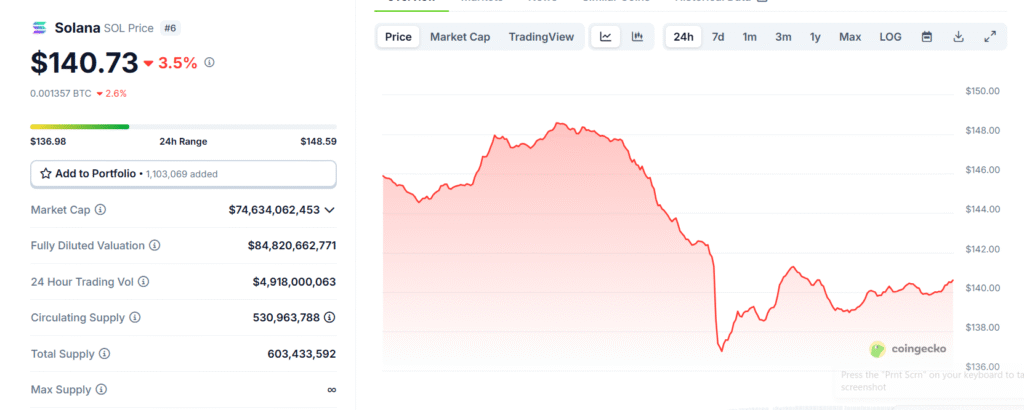

Solana (SOL) is capturing attention with a promising setup. According to a recent post by @Morecryptoonl on X.

SOL remains range-bound between $142 and $158, suggesting the completion of a corrective wave (2). A decisive break above $159.50 could shift momentum, potentially igniting the next bullish leg. This technical outlook aligns with fundamental developments, making SOL a standout in the Layer-1 blockchain race.

A key driver is Solana’s recent upgrade, increasing block capacity by 20%, as reported by CryptoNews. This enhancement, part of the Agave v2.2 update, boosts throughput to approximately 65,000 transactions per second (TPS) from 50,000 TPS, challenging Ethereum’s dominance narrative. Coupled with a rising Total Value Locked (TVL)—up from $5.1 billion to $5.8 billion in the past month per DefiLlama data as of June 12, 2025—SOL’s ecosystem strength is evident. Higher TVL reflects growing DeFi activity, a bullish signal for price appreciation.

Despite an annual inflation rate of 4.462% (SolanaCompass), SOL has shown resilience, with a staggering 27,983.30% gain from its all-time low. While non-stakers face dilution, staking rewards remain attractive, supporting network security. However, SOL has dipped -4.50% this week, testing support levels. If it holds, analysts predict a potential rally toward $210, as suggested by FXStreet’s November 2024 forecast, with $225 as a longer-term target.

For investors, SOL’s blend of technical promise and fundamental growth positions it as a leader in the next crypto uptrend. Watch the $159.50 level closely.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.