- SOL’s options market sees 80% block trades in bearish put options.

- March 1 unlock will release 11.2 million tokens worth $2.07 billion.

- Solana price falls 46% as blockchain activity and volumes decline.

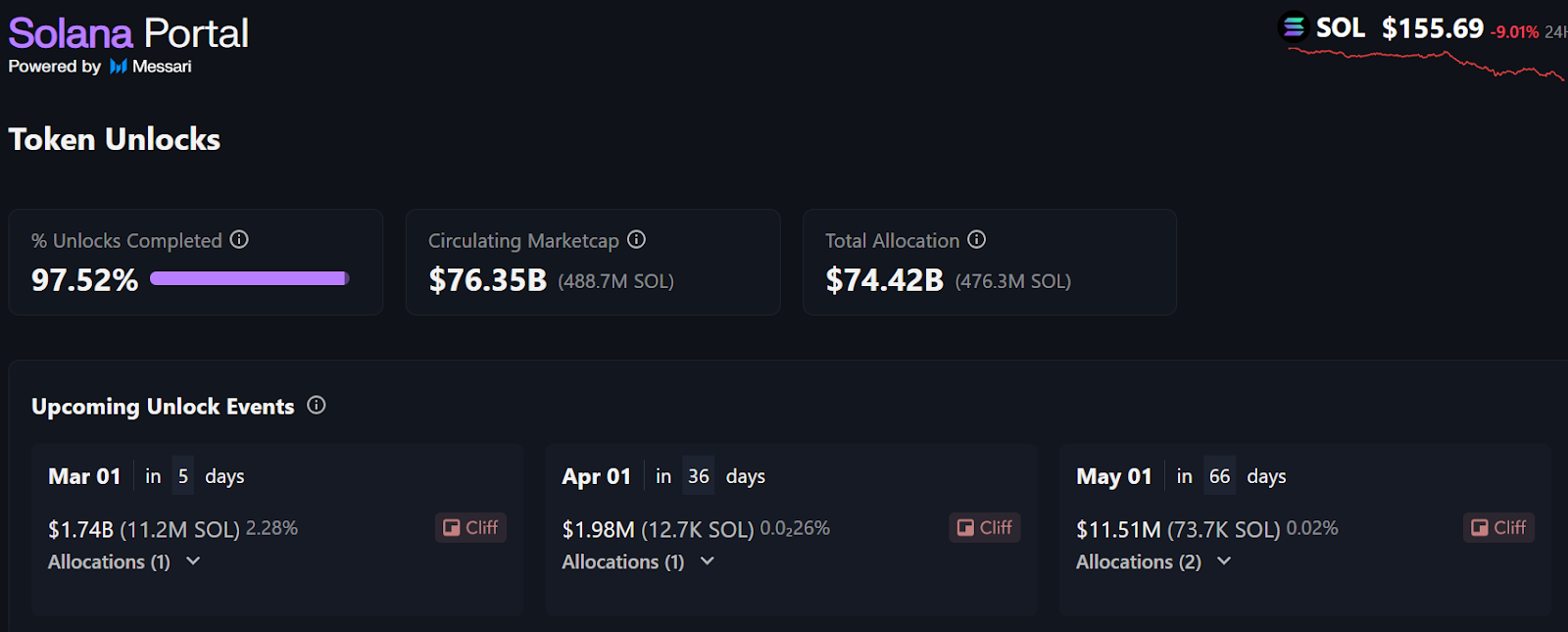

Solana (SOL) is experiencing a surge in bearish sentiment on Deribit’s options market. Large investors, often called whales, place significant bets against the token. This bearish activity aligns with SOL’s declining price, and an impending significant token unlock scheduled for March 1. The unlock will release 11.2 million SOL tokens worth approximately $2.07 billion. This influx, representing 2.29% of SOL’s total supply, has heightened market anxiety. Traders anticipate increased volatility, prompting a rush toward put options to hedge against potential losses.

Block Trades Dominate SOL Options Activity

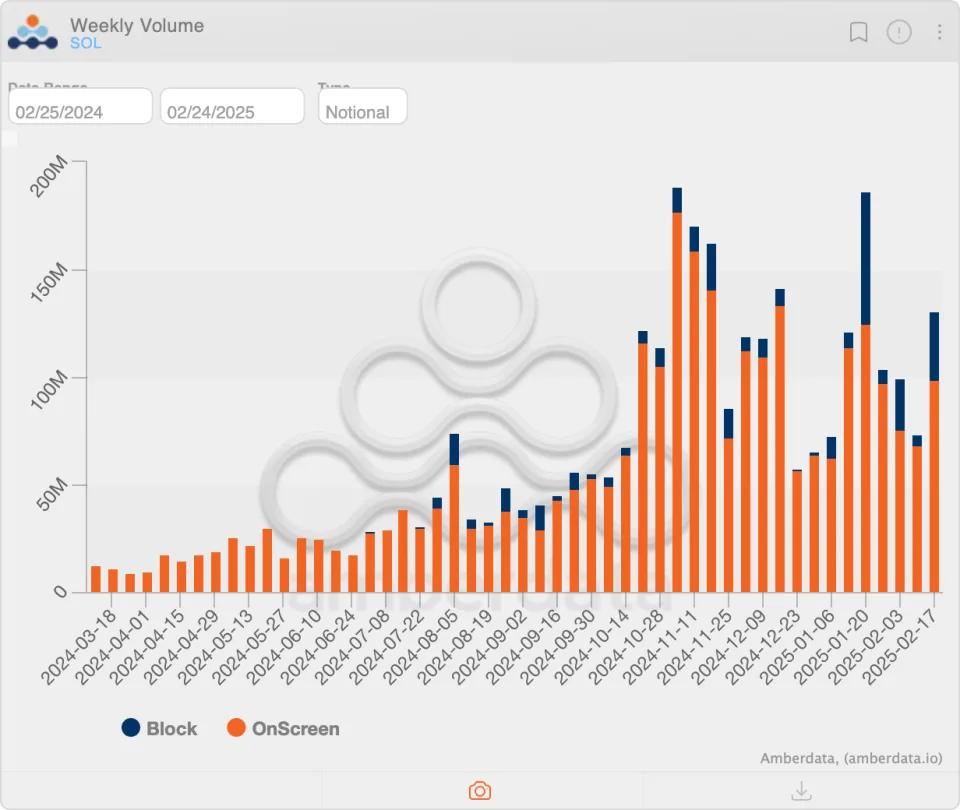

Last week, block trades in SOL options reached $32.39 million, accounting for nearly 25% of Deribit’s total options volume of $130.74 million. Large privately negotiated block trades are often associated with whale activity. These deals occur over the counter and settle on the exchange, minimizing market disruption. Notably, 80% of SOL’s block trade volume concentrated input options.

By comparison, as Greg Magadini, director of derivatives at Amberdata, stated, Bitcoin and Ethereum’s put volumes during the same period were 40% and 37.5%, respectively. This heavy skew towards puts underscores prevailing bearish expectations among institutional players.

SOL Price Decline and Network Activity Slowdown

SOL’s price has plummeted 46% over the past five weeks, trading at $161.50 with a daily volume of $2.84 billion. This drop mirrors declining activity on the Solana blockchain.

Once a hub for memecoin trading, the network’s transaction count and decentralized exchange volumes have tapered off since mid-January. The launch of the TRUMP token on January 17 briefly revived interest, but momentum has since faded. This slowdown weakens the bullish case for SOL, further fueling bearish bets in the options market.

Impending Token Unlock Raises Volatility Concerns

The upcoming March 1 token unlock introduces another layer of market uncertainty. With 11.2 million SOL entering circulation, nearly 59% of the token’s daily spot trading volume, investors fear downward price pressure.

Most released tokens originate from the FTX estate and a foundation sale. The scale of this release is substantial, prompting many traders to adopt hedging strategies through put options. As volatility expectations rise, some market participants take long positions to capitalize on potential price swings.

Market Outlook Remains Cautious

The increased activity of bearish options, SOL’s price decline, and the looming token unlock created a cautious market atmosphere. Traders and institutional investors continue to monitor these developments, adjusting strategies to navigate anticipated volatility. With bearish market sentiment, all eyes remain on Solana’s price action in the coming weeks.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.