- $200 Support Holds the Line – Solana trades steadily above $200, with critical micro support at $192–197 and deeper demand at $181–166.

- Open Interest Signals Potential Breakout – Rising open interest at 6.27B shows positioning for volatility, hinting at a stronger market move ahead.

- Overbought Momentum Adds Pressure – CRSI at 77.1 warns of near-term resistance, but a sustained breakout above $212 could unlock higher targets.

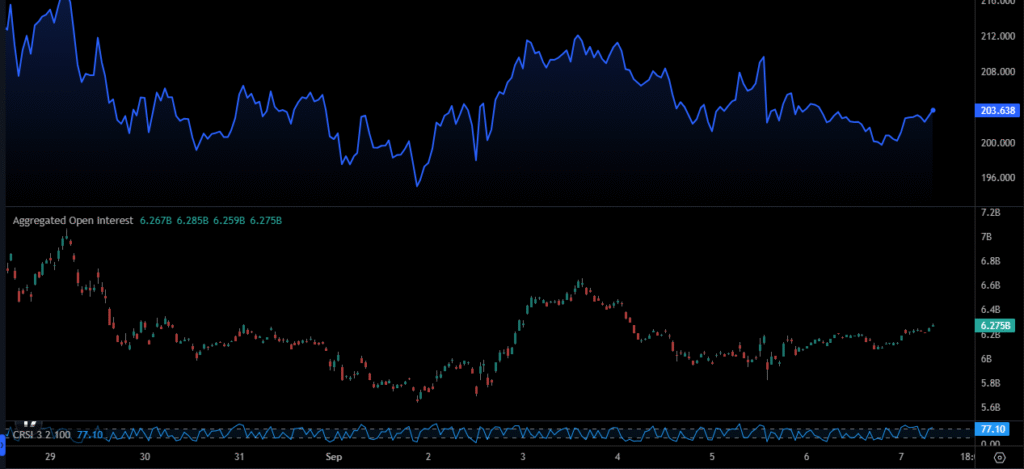

Solana trades around $203 after a week of sideways movement between $196 and $212. Price action highlights critical zones ahead. Support remains firm at $192–197, while deeper levels at $181 and $166 represent the next defense areas.

Resistance continues at $212, and additional supply sits between $218 and $220. These areas form the barriers that bulls must overcome. A breakout through these zones could signal renewed momentum and a stronger upward trend.

Market behavior shows consolidation without directional conviction. Buyers defend support, but sellers remain active near resistance. Consequently, the next decisive move is still pending.

Open Interest and Market Positioning

Aggregated open interest holds at 6.27B after recovering from earlier declines. Market participants continue to build positions while price holds steady. The alignment of rising open interest with a stable price signals preparation for a stronger move.

Source: Coinanalyze

If open interest rises with a corresponding price breakout, conviction will strengthen. However, if open interest rises without movement, uncertainty lingers. Such conditions suggest traders are positioning while awaiting a catalyst.

Overall, open interest trends support the possibility of near-term volatility. Any sustained spike could push the market away from its current range. Therefore, positioning remains critical for the next development.

Momentum and Market Implications

The Composite Relative Strength Index currently reads 77.1, placing Solana in overbought conditions. This metric signals possible short-term resistance to further upside. Sustained movement above this level requires strong volume and continued demand.

If price maintains levels above $200 while open interest climbs, bulls may attempt another push toward $212. A breakout there could unlock higher targets beyond $218. However, a rejection risks a drop back to $196–200.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.