- STX holds support at $0.440, nearing resistance at $0.455 after Grayscale Trust launch.

- Grayscale’s STCK Trust brings regulated access to STX for U.S. investors.

- Stacks (STX) rebounds to $0.4473, showing mild bullish momentum after recent drop.

Stacks (STX) is showing signs of recovery as its price stabilizes around key support levels. This comes amid the launch of Grayscale’s new Stacks Trust (STCK), which could influence price movement by providing U.S. investors with regulated access to STX.

STX Price Holds Support Near $0.440

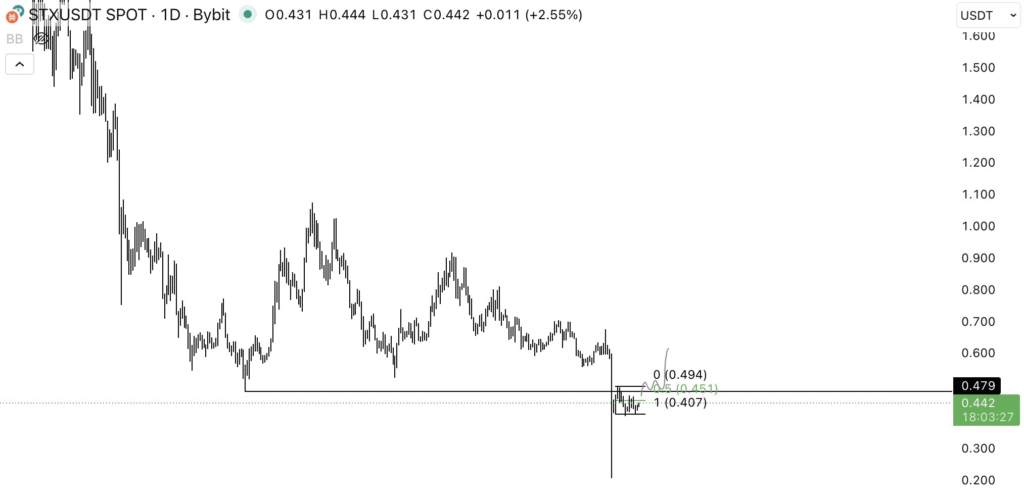

Stacks (STX) has experienced a mild recovery following recent losses, maintaining support at $0.440. The price is currently trading at $0.4473, up 0.91% over the past 24 hours.

This price movement follows a significant drop to $0.40, which prompted a rebound as buyers stepped in around the support level. Traders are watching key price levels closely, as STX moves toward testing resistance at $0.455.

Grayscale Launches STCK Trust with U.S. Access to STX

Grayscale’s new STCK Trust is now available to U.S. investors, providing a unique way to invest in Stacks (STX). By listing the Trust on the OTCQB® Market, Grayscale has made it easier for investors to gain exposure to the growing Stacks ecosystem.

This development strengthens the perception of Stacks as a legitimate and accessible investment option.

Stacks founder Muneeb Ali remarked that the launch of the Trust “expands Bitcoin’s utility through smart contracts.” The introduction of this product is seen as a step forward in bringing Bitcoin-based technologies into the traditional investment landscape.

As a result, the Grayscale Trust could attract more institutional and retail investors who were previously hesitant to engage with Stacks directly.

Technical Outlook for STX Price Movement

Stacks is facing a critical point in its price action, with the token holding above the $0.440 support level, which is a crucial point for maintaining any bullish momentum. Resistance is seen around $0.455, and a breakout above this price could signal a stronger upward move.

The price is testing these levels after a recovery from a recent low of around $0.40. With the launch of the STCK Trust, the involvement of a regulated product could increase investor confidence in Stacks, potentially driving more buying interest.

As STX maintains its support, traders will closely monitor the price to see if the token can break above resistance and continue its recovery. However, any failure to hold the $0.440 support could result in a retracement toward lower levels.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. CoinCryptoNewz is not responsible for any losses incurred. Readers should do their own research before making financial decisions.